Forex news for New York trade on May 5, 2017:

- April 2017 nonfarm payrolls 211K vs 190K expected

- Canada net change in employment 3.2K vs. 10.0k estimate

- Kevin Warsh takes no prisoners in dressing down of the Fed

- Fed's Williams: Wage growth has been stubbornly slow

- Williams: Recent data consistent with steadily improving economy

- Williams: Price level monetary policy warrants serious study

- Highlights from Evans, Bullard and Rosengren

- Baker Hughes US oil rig count 703 vs 697 prior

- Fed's Bullard wants to start trimming balance sheet in H2

- New York Fed cuts Q2 GDP forecast to 1.8% from 2.3%

- Gary Cohn: The US still isn't seeing wage inflation

- Ivey Canada PMI 62.4 vs 61.1 prior

- CFTC Commitments of Traders: EUR specs squared up. GBP positions trimmed

- US consumer credit $16.431B vs est $14.000B

- No comments on monetary policy from Yellen or Fischer

Markets:

- S&P 500 up 10 points to record 2399

- US 10-year yield flat at 2.35%

- WTI crude up 96-cents to $46.48

- Gold flat at $1228

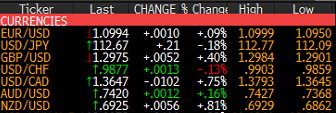

- NZD leads, JPY lags

Wages were the trade once again. Nonfarm payrolls were strong and the unemployment rate slipped and the dollar initially rose but only for a moment. Seconds later it reversed as the market refocused on wages.

EUR/USD dipped to a session low of 1.0940 and then jumped to 1.0987. After that the bears and bulls had an epic battle around 1.1000 but three campaigns to bust through were all beaten back with highs of 1.0999 and the pair finished back at 1.0987. There's plenty of talk that a Macron win will take it through and you won't find any argument here. But at this point it should be mostly priced in so it might not last.

Cable also took out the recent highs as it climbed to 1.2985 and the best levels since October. It finished near the best levels of the day in what's a positive sign for the pound.

USD/JPY was largely indifferent to the data as it chopped around 112.60. That's where it finished as bonds compete with commodities, data and Fed talk for the imagination of the market.

USD/CAD ended its 10-day winning streak with a big reversal. Canadian jobs numbers were weak but that couldn't give a lift to USD/CAD. The market took that (along with rising oil prices) as a cue to sell and the pair dove 100 pips lower to 1.3649.

The Australian and New Zealand dollars also caught a bid in a relief rally but it was much smaller than CAD.