Forex news for NY traders on February 24, 2017

- Fitch affirms Greece at CCC

- US stocks claw back losses and close higher on the day. Dow 11th straight record.

- CFTC commitment of traders report: EUR shorts increase as Paris election may be an influence

- Baker Hughes oil rig count 602 vs 597 prior

- Border adjustment tax plan is coming but we're not sure which one

- French jobseekers inch higher in January

- Another week of mediocre FX moves

- European stocks slip to close out the week

- New York Fed Q1 GDP forecast unchanged at 3.1%

- Canada April-Dec budget deficit $14B vs +$3.2B a year ago

- Trump: We are going to 'massively' reduce taxes

- Trump: I'm not against the media, I'm against fake news

- U Mich final Feb consumer sentiment 96.3 vs 95.7 prelim

- US new home sales for January come in at 555K vs 571K est.

- Political hedging could be weighing on yen crosses

- Trump to sign executive order establishing regulatory reform officers

- Canada January CPI +2.1% y/y vs +1.6% expected

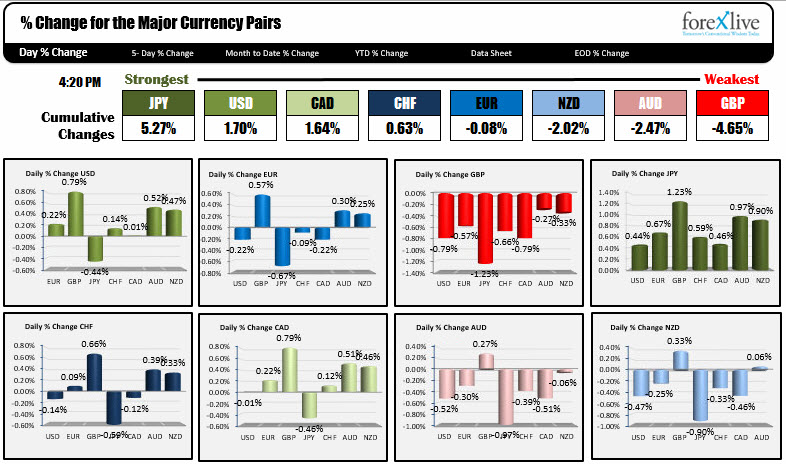

- The strongest and weakest currencies as NA traders enter for the day

In other markets today:

- S&P up 0.15%

- Nasdaq up 0.17%

- Dow up 0.05%. The 11 consecutive record close.

- 2 year 1.144% -3.7 bp

- 5 year 1.804% -5.4 bp

- 10 year 2.313% -5.8 bp

- 30 year 2.951% -6.0 bp

- WTI crude $54.03, -$0.41 or -0.75%

- Spot gold $1256, $7.00 or 0.57%

The data was light today. Canada CPI was better than expectations. The USDCAD fell to the days lows and then rebounded and retraced the declines.

In the US, new home sales came out weaker than estimate at 555K vs 570K annualized pace. The number was still higher than the prior month at 535K.

The University of Michigan sentiment index (final) was revised higher to 96.3 from 95.7 original estimate. The current condition was revised to 111.5 from 111.2. THe Expectations index rose to 86.5 from 85.7. Inflation expectations out to 1 year fell to 2.7% from 2.8% and 5-10 year expectations remained steady at 2.5%

President Trump spoke at the Conservative Political Action Conference (CPAC) in Washington. Compared to a day ago when he was in front of 24 business leaders, the crowds were there, the camera's were running, the music was playing, and as a result, it was a rerun of "The Best of Donald Trump" from the campaign trail. Little was said about taxes/regulations (will he get more specific when he speaks in front of the House and Senate?). There was lots about "fake news", Obamacare, Hillary. there was "The Wall" and how he inherited a "disaster" and to make sure that those who came in late would not miss the details, he repeated himself in different ways. There are good days. There are bad days. I prefer when he is looking for ways to solve problems. I don't love when he divides.

Bond yields fell. it may have been a combination of France concerns and general flight into quality. The stock market did rally though. The major indices were going into the speech with the Nasdaq down about 22 points and the S&P down about 8 points. By the end of the day, those indices were up on the day. The gains were marginal, but the Nasdaq was down about -35 points at the low and ended up about 10 points. So love him or hate him, the market is putting their trust in Trump.

What about some of the major currency pairs. What are the charts saying?

The EURUSD is ending down on the day and near the lows for the day (down 0.22%). This was a reversal of the strength seen at the start of the day (was up 0.25% as NA traders entered for the day). The move lower was sharp and quick. The move lower stalled at the 100 hour MA now once, not twice but over the course of the day, 5 days. IN the last few hours, that MA was broken (it is a 1.0562), and the pair is closing modestly below that MA. In early trading next week, the MA line will be a key level to stay below if the bears are to stay in control. Another key target on the downside in the new week will be 1.0503-20 (see post here).

The USDJPY is ending the week around the 112.00 level and is the biggest mover of the day vs the USD. The pair is ending down 0.79% on the day (USD lower by that amount). The selling started in the London session and fell below support at 112.51-57 in the process. The pair stalled against the 112.00 level three separate times before breaking. The high correction could only get to 112.47. In the new trading week, the 112.51-57 is risk for shorts. Stay below, more bearish. More momentum below the 112.00 level have traders looking toward the 100 day MA at 111.58. The last time the USDJPY traded below the 100 day MA? November 9th - the day Donald Trump won the US election.

The GBPUSD traded at the highest level since February 9th today at 1.25688, but tumbled with the rebound in the USD into the close. The pair is ending below a cluster of MAs between 1.24688 and 1.2484. Those MA will be close resistance for shorts in the new trading week. The key targets to the downside will come in between 1.2403 (100 day) MA and the 1.2411/17 area (swing levels going back to mid-January.

The AUDUSD rallied to topside resistance for the 2nd week in a row on Thursday (between 0.7730 and 0.7755). That area stalled the rally and today was spent moving lower. We are ending the day near the low. For a complete review of the pair CLICK HERE.

The NZDUSD has been in a trading range over the last 11 or so trading days. The low on Tuesday took out the Feb 14 low by 4 pips and failed. The high on Thursday took out the high from Feb 16 by 4 pips and failed. There is symmetry at least. The price is sitting in the middle of the 11 day range around 0.71877 as the week comes to an end. Which way do we break in the new trading week. For a more detailed look at the pair, click here.

Below are the % changes for the major currencies vs each other.

Wishing all a happy and healthy weekend.