Forex news for North American trading on Feb 10, 2017:

- Canada January employment +48.3K vs -10.0K expected

- February 2017 US Michigan consumer sentiment flash 95.7 vs 97.9 exp

- Trump and Abe press conference highlights

- Exactly what Trump said on currency devaluation

- Trump: Senkaku islands will be protected. Japan is top ally

- Fed's Tarullo will resign on or around April 5

- Baker Hughes US oil rig count 591 vs 583 prior

- Fed's Mester: We're not behind the curve yet on rate hikes

- Fed's Mester: Fed must be willing to alter outlook as economy changes

- ECB's Nowotny: We don't need the IMF, Greece is a European problem

- NY Fed Q1 GDP estimate bumped to 3.1% from 2.9%

- January 2017 US import prices 0.4% vs 0.2% exp m/m

- CFTC FX Commitments of Traders: US dollar longs pared for fifth week

Markets:

- Gold up $5 to $1233

- WTI up 79-cents to $53.79

- S&P 500 up 8 points to 2316

- US 10-year yields up 1 bps to 2.40%

- AUD leads, EUR lags

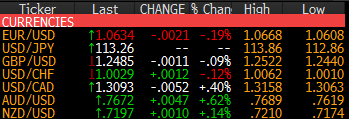

The early story was another blockbuster Canadian jobs report. The strong numbers cut USD/CAD down to 1.3060 from 1.3140 in a quick move. But the bottom came shortly after in the pair despite a strong day for oil and it slowly climbed back to 1.3090. Despite the quick move, volatility in the latter half of the day was less than 30 pips.

Coming into the day, the focus on was on Abe and Trump. The press conference briefly sent USD/JPY higher on positive sentiment and then Trump made some cryptic comments about currency devaluation and that sent the pair quickly to 112.80 from 113.36. But the decline didn't last long and the pair recovered to 113.50. Part of that USD strength was about the record high in stocks.

EUR/USD bottomed early in the day at 1.0610. That's the worst since Jan 19. Despite some minor stops, the pair found support there and it recovered to 1.0650.

Cable traced out a bottom after two challenges of 1.2440 early and then bounced to 1.2505. The move on the day was less than 10 pips -- one of the smallest since Brexit.

The Australian dollar had a strong finish to the week with most of the rally coming in US trading. The Aussie outperformed the loonie Friday despite the strong Canadian jobs report. The 0.7700 has been tough to break for the Aussie in the past two weeks and the high was 0.7689 Friday. Watch for another push early next week.