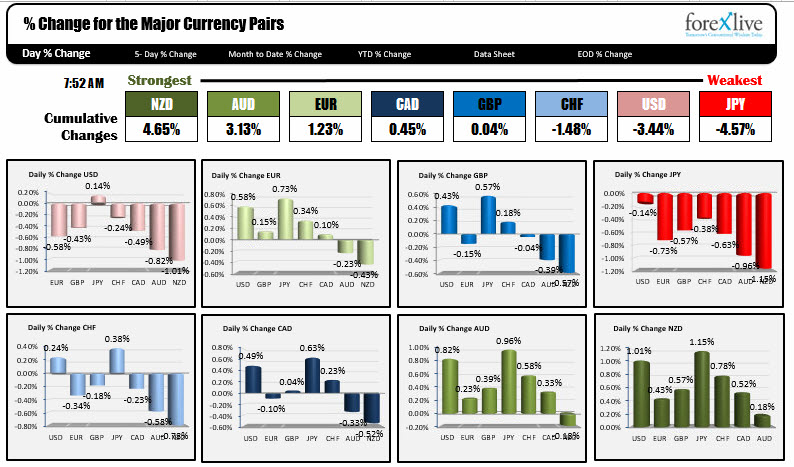

The NZD is the strongest. The JPY is the weakest.

As the NA session begins, the North Korea denuclearization opening and some hope that the pieces of tariff puzzle fall into place has funds flowing into the NZD, AUD and CAD and out of the "relative safety of the JPY". The USD has also reversed.

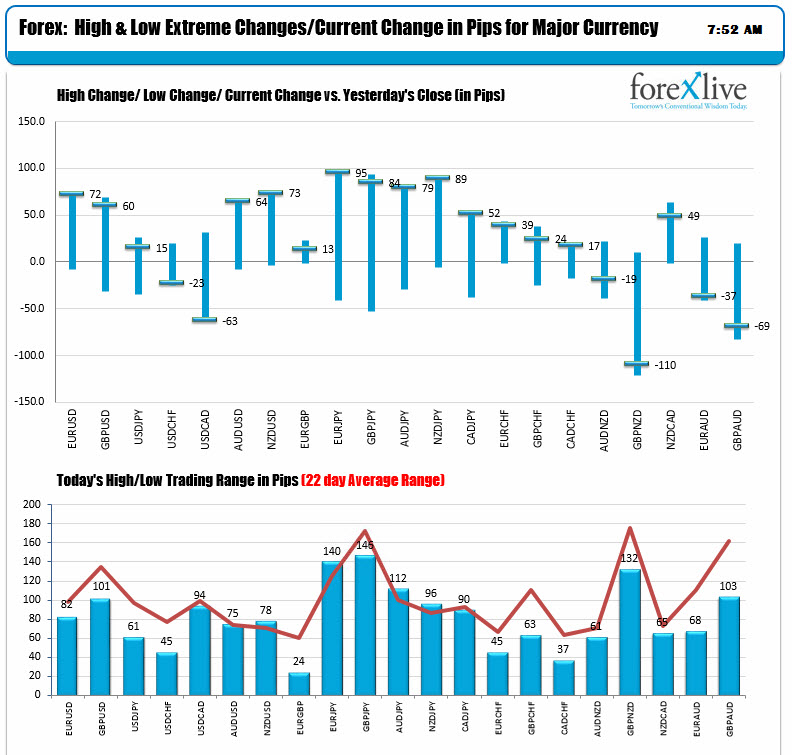

The changes and ranges are showing good volatility, with a lot of the pairs starting the North American session at extreme levels.

- The JPY crosses are all at the highs.

- The commodity currencies are at the extremes.

- The EURUSD and GBPUSD are trading at highs.

In other markets:

- Spot gold is moving higher with the decline in the US dollar. It is up $10 on the day at $1330.26

- WTI crude oil futures are trading of $.57 or 0.91% $63.14

- US treasury yields are up about one basis point across-the-board. Two-year 2.25%, up 0.9 basis points. Five-year 2.655%, up 1.0 basis points

- 10 year 2.89%, up 1.0 race points

- 30 year 3.16%, up 0.5 basis points

The US stock futures are calling for higher openings

- Dow futures implya 150 point rise

- S&P futures imply a 11 point rise

- NASDAQ futures imply a 39 point rise

European stocks are higher:

- German DAX +0.9%

- France's CAC +0.7%

- UK's FTSE +0.8%

- Spain's Ibex, +0.7%

- Italy's FTSE MIB +1.8%

European ten-year yields are mixed:

- Germany 0.691%, +4.7 basis points

- France 0.942%, +3.5 basis points

- UK 1.549%, +5.4 basis points

- Spain 1.44%, -1.4 basis points

- Italy 1.996%, -0.6 base points

- Portugal 1.927%, -2.6 basis points