The activity is limited but lots of data out today.

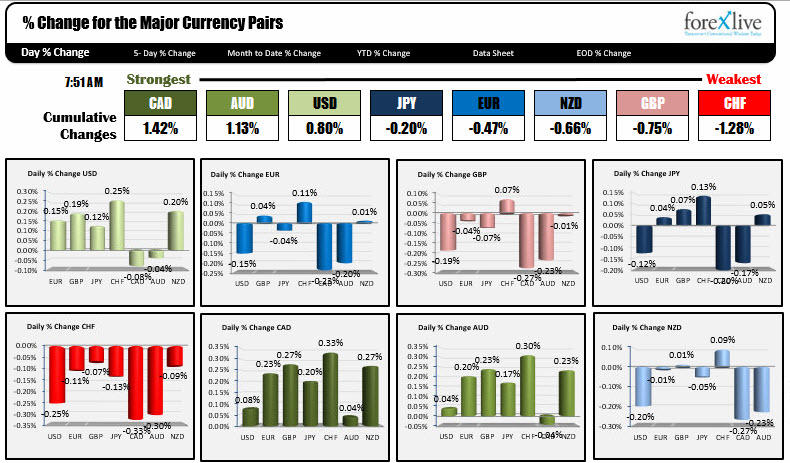

As the North American traders enter for the day, the CAD is the strongest, while the CHF is the weakest. However, note that the pairs are bunched together so the order has the potential to be shuffled around on liquidity moves.

There is a lot of data out at 8:30 AM ET, with CAD CPI, and retail sales. The ADP non-farm employment change for Canada will also be released. In the US, the GDP, Philly Fed Manufacturing index, and unemployment claims will be released. Later at 10 AM ET, EU consumer confidence and the Conference Board Confidence numbers will be released.

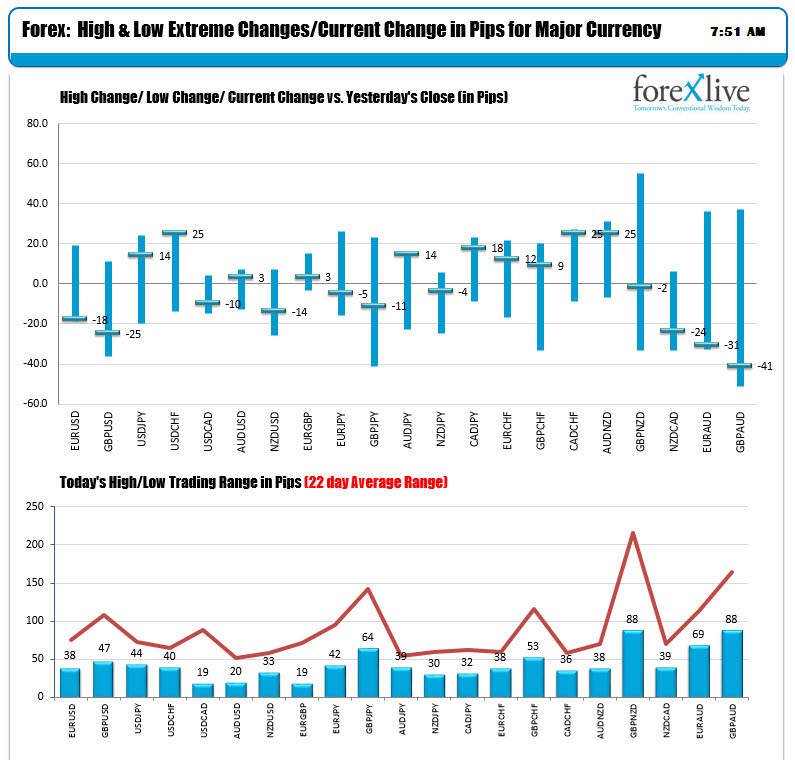

Rigth, now you can see the holiday trading in the ranges so far today. The snapshot shows all of the pairs well below their 22 day average ranges.

The USD is higher on the day vs all the majors with the exception of the CAD and AUD. The biggest change is against the CHF.

In other markets, the snapshot shows:

- Spot gold down -$0.89 at $1264.72

- WTI crude oil is down -$0.22 at $57.88

- US yields are lower today after a string of days where yields rose. 2 year 1.8528%, down -0.4 bp. 10 year 2.4808%, -1.6 bp. 30 year 2.86%, -1.6 bp

- US stocks are up a little in futures trading: S&P is up 5.75 points. Dow futures are up 36 points and Nasdaq futures are up 8.75 points.

- In Europe, stocks are little changed. The German Dax is unchanged. France's Cac is unchanged. The UK FTSE is bucking the trend up about 0.48%.