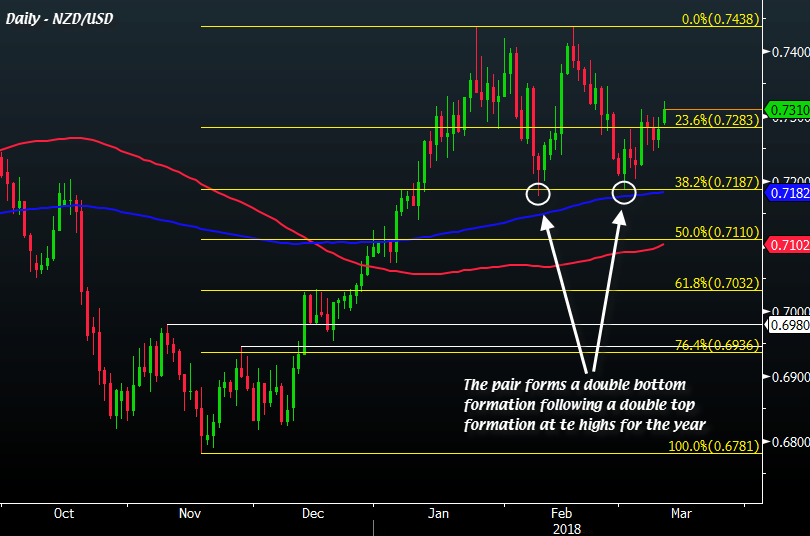

The pair is breaking free of the 23.6 retracement level on the daily chart

The boost in risk sentiment over the last two trading days have given a fresh lease of life to the pair, as it shakes off the 23.6 retracement level @ 0.7283 on the daily chart to break above 0.7300 now.

Looking at things from a wider perspective, the pair formed a double top formation at the highs of 0.7438 in January and February, and that led to a fall to the lows supported by the 38.2 retracement level @ 0.7187.

The most recent rebound this month sees the pair now form a double bottom formation at the lows, and from a technical perspective it provides a strong conviction for a run up to test the year's highs again.

If the positive vibe from risk sentiment is sustainable this week (that will depend on Trump's mood), there's no reason why the pair shouldn't see a test of the highs again. But do watch out, there are a couple of big risk events for the kiwi on the week too.

First up there's RBNZ governor Grant Spencer speaking tomorrow and his speech will be related to macro-prudential policy. And after that on Thursday, we'll have New Zealand Q4 GDP data.

On the dollar side of the equation, there's retail sales and PPI figures due on Wednesday so be on the look out for those too.