Tumble today continues on BOJ

The BOJ trimmed the bond purchases in trading yesterday. That got bond yields moving higher and a run higher in the JPY (lower USDJPY). That trend continued today will an extra boost from some dollar selling on concerns China might curtail US bond buying (does not see value).

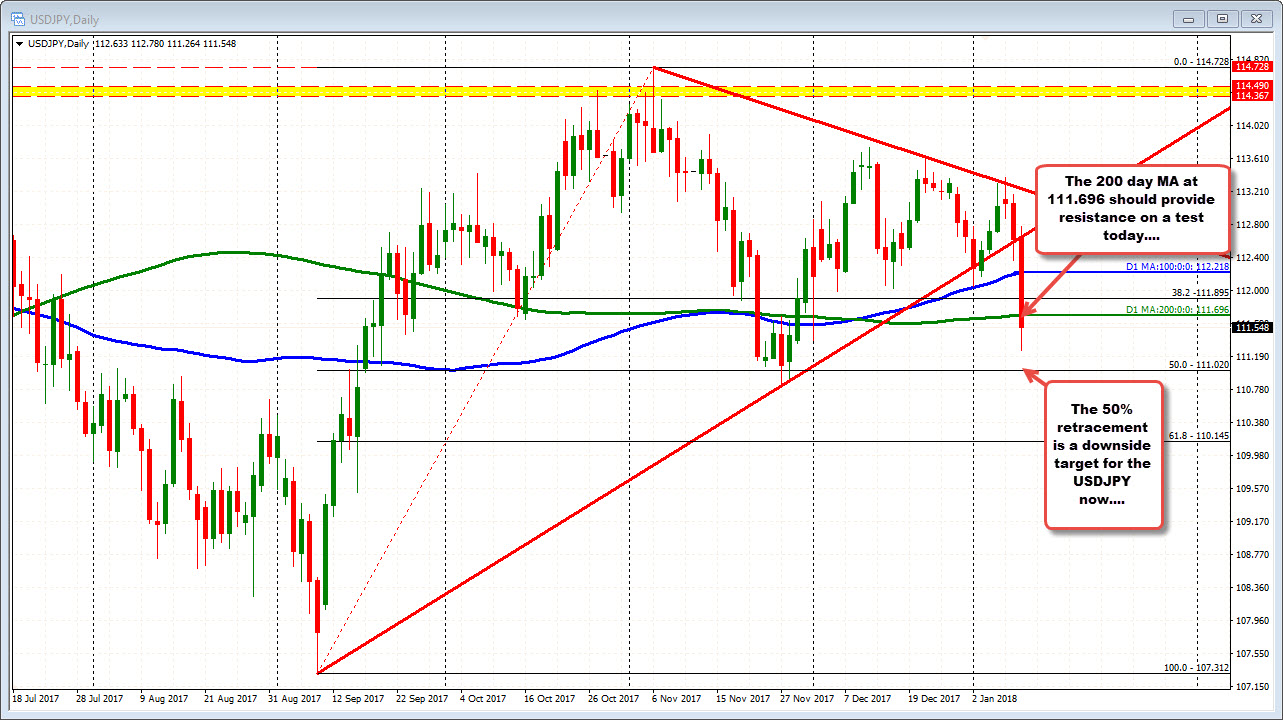

Technically, the price tumbled below key daily MAs. The 100 day MA at 112.218 and the 200 day MA at 111.696 were breached. The low reached 111.26. The price has rebounded a bit up and trades at 111.54 currently. I would expect that 200 day MA should provide sellers a level to lean against on a test.

Drilling to the 5-minute chart below, the 100 bar MA (blue line) is moving toward the 200 day MA (it is at 111.73 while the 200 day MA is at 111.697). That too should give sellers a level to lean against on a test. A move above both may, however, give sellers a cause for pause. So look at the MAs as a key barometer for bullish and bearish today.