Moves away from 100 day MA. Extends narrow trading range.

The USDJPY has jumped higher after the better than expected US data. Construction spending shows strength and should give 4Q GDP a boost and the ISM Manufacturing rose more than expectations at 59.7 vs 58.2 estimate.

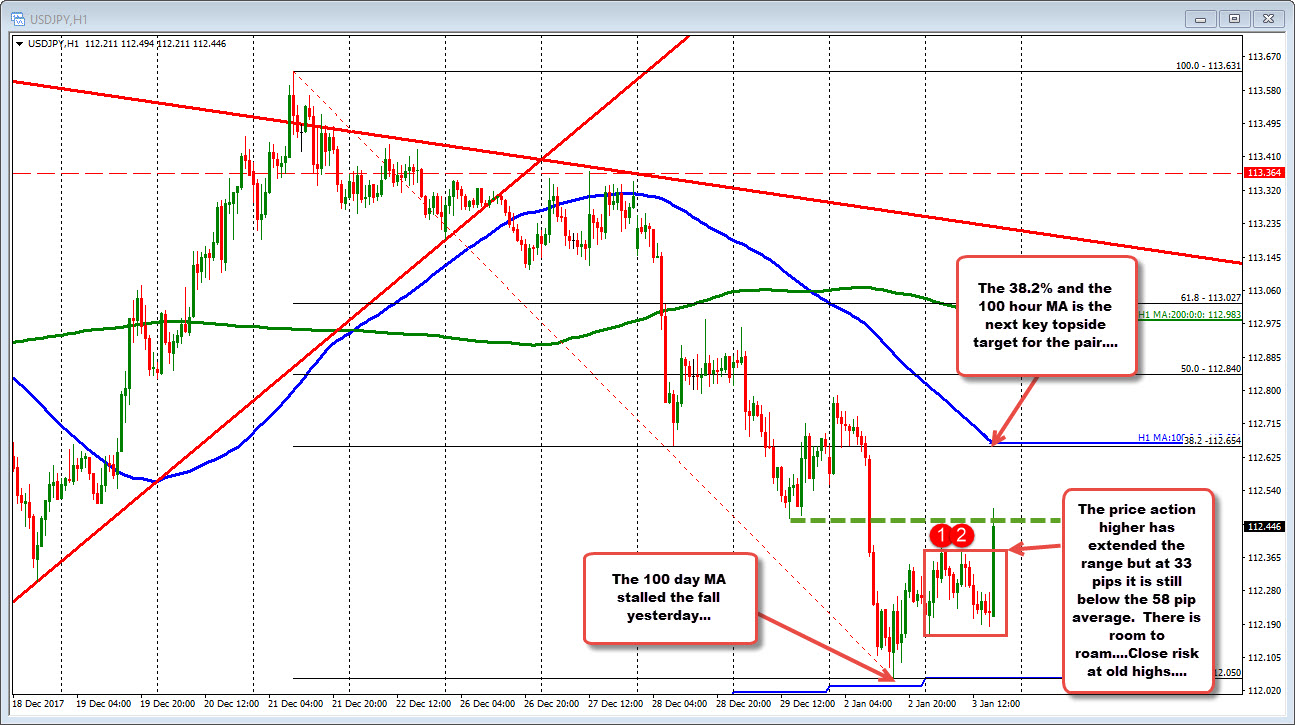

That backdrop was able to push the USDJPY to new session highs and further away from its 100 day MA (blue line at 112.05 today). Recall from yesterday, that 100 day MA was tested and held (see: USDJPY has a key technical reason to think a low is in for today).

The price action today was up and down in a narrow trading range - only 23 pips or so before the last move higher. The last push has raised the range to 33 pips which is still light compared to the average range over the last month of 58 pips. I like to say, "There is room to roam".

Technically, the 38.2% and 100 hour MA come in at the 112.66 area. That would be a topside target on continued buying today. The combination should give traders some cause for pause should there be a test, but it is a doable target today.