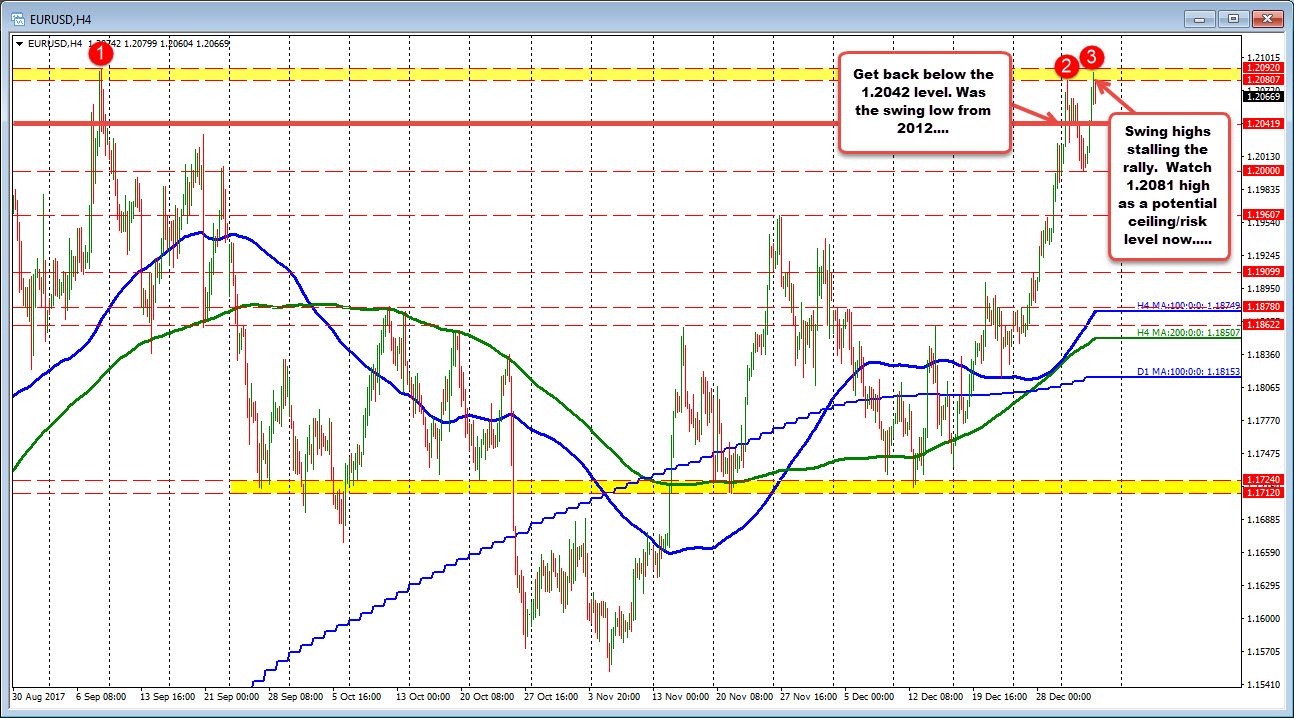

Risk 1.2081 now...

The EURUSD moved above the high from earlier in the week at 1.2081 and got within 4 pips of the 2017 high at 1.2092 (the high reached 1.2088). The last few hours of trading has seen a high of 1.2080 - below the 1.2081 high from earlier this week. Is the market telling us that the buyers are giving up on the run higher? Has the run up over the last few weeks that saw the price base against the 1.1712-24 area and move up to 1.2088 gone far enough? Fundamentally, can the EURUSD bullish enthusiasm continue at the 1.2100 level? Does it make sense that the dollar goes lower when stocks are ripping higher, fiscal policy is expansionary and the Fed is still looking to raise rates (and the ECB is not)?

It is hard to pick a top, but the slowing against the 2017 high might be showing the "market" is tilting a little back to the downside.

I would think if it is the case, the high at 1.2081 should be the lid now. What would make the picture more bearish? A move back below the 1.2042 level to start. That was the swing low from 2012. Today we raced back above that level on the way to the retest of the high.

What is in the way?

US employment tomorrow. That is a big risk event.

If that report is weak (it is not expected to be with expectations at 190K), the dollar may continue its run down (EURUSD higher).

However, if between now and then the price rotates/wanders back toward the 1.2042 level (and potentially below. Other support is at 1.2000), it could set up for betting the winnings on a stronger number. That would be your choice.

Is the price action saying a top is in place before NFP? Maybe. Stay below 1.2081.

If the price goes lower - with 1.2042 and 1.2000 support) - it might provide an opportunity for shorts to bet the profits through the employment report. If there is a strong report, the EURUSD should have more room to run lower.