NY correction held support. Options expired. The pair traded to new highs.

In an earlier post, I spoke to the option settle at 10 AM. There was a chunky amount expiring with a strike of 1.1790-1.1800. At the option close, the price of the EURUSD traded at 1.1797 - right between the option strike goal posts. Option seller saw the time value melt away.

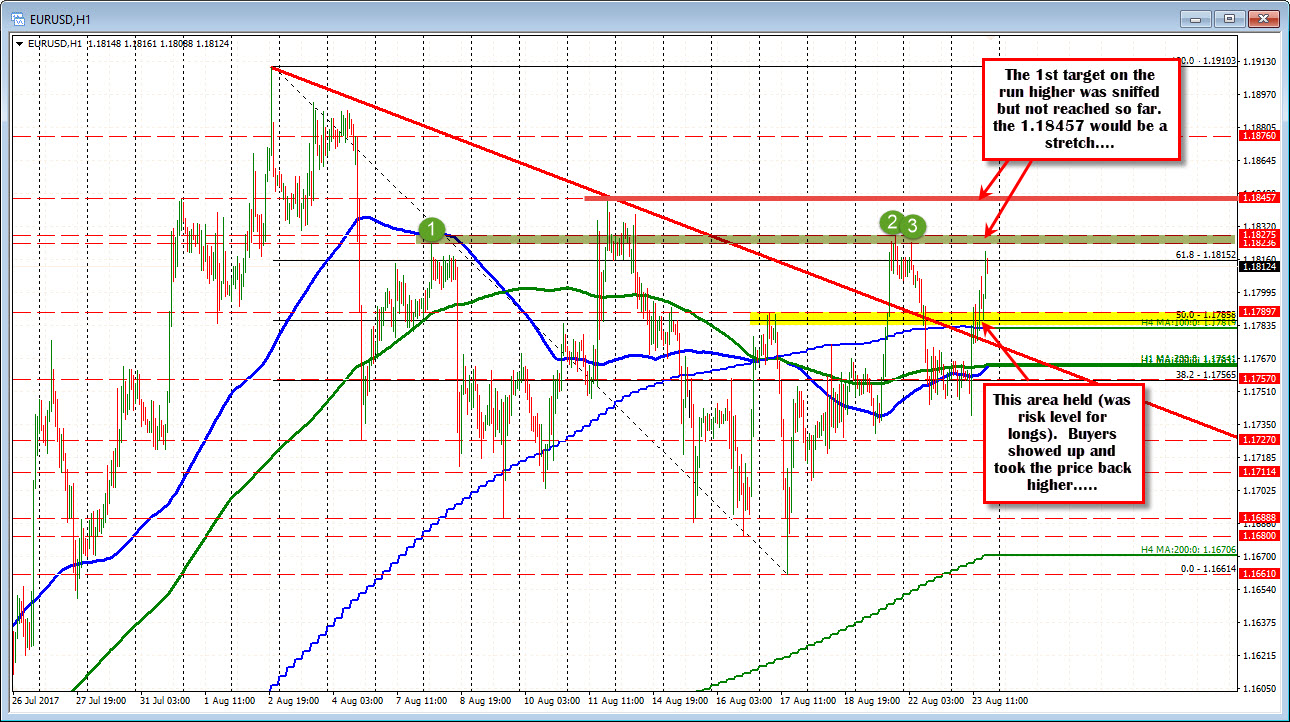

Earlier I also spoke to the support at the 50% and the 100 bar MA on the 4-hour chart at 1.1782-858 ("Be on the lookout for a dip toward the 50%/ 100 bar MA on the 4-hour chart and buyers to show up there."). The dip stalled at the 50% at 1.1786.

The price has since moved to new session highs at 1.18195.

Overall, the EURUSD did what it was supposed to do:

- The correction stalled at support

- The options expired around the strike prices (giving the sellers exactly what they wanted),

- The price rallied and extended the range to 1.18195.

Perfect.

What now?

Well, the technical story from earlier is not totally complete. The targets to the upside has come up a little short. The 1.18236-275 was the first target. The next at the August 11 high at 1.18457. That higher target would be a stretch for trading today.

Is 1.18195 close enough?

It could be. It gets tougher the higher you go. However, the range for the day is 80 pips now. The 22 day average is 95. So there is some room to extend. However, the pips should be harder as the price goes higher.

What would take some wind out of the bullish sails?

A move below 1.1800 would muddy the waters - at least intraday.