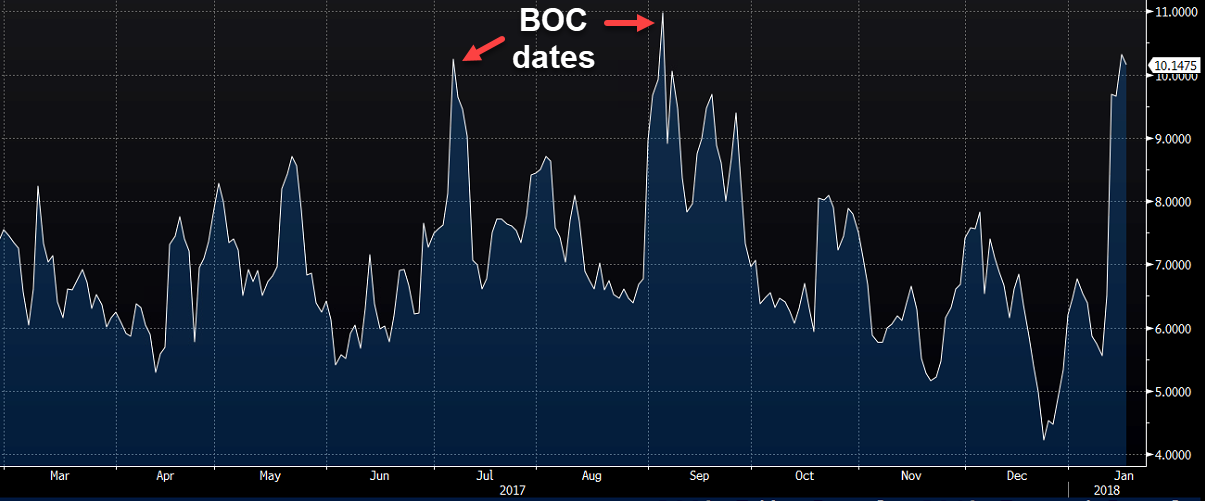

One-week Implied volatility at the highest since September

The odds of a Bank of Canada hike on Wednesday are near 90% but that doesn't tell the whole story.

One-week implied volatility is at the highest since September.

The problem isn't so much the decision itself -- the BOC will almost-certainty hike -- but the communication.

Poloz has been all over the place with his signals. In Nov/Dec the BOC emphasized caution in the statement and that was taken to mean sitting on the sidelines, but last month Poloz went to great lengths to say caution meant they could still move and that they were data dependent.

After a run of the three-best Canadian jobs reports on record, the market is taking him at his word and pricing in hikes.

The problem is that the BOC has essentially abandoned its ability to signal anything.

"In the event that we do get a hike, it would be a dovish hike," said Eric Theoret, a currency strategist at Scotiabank.

In theory that makes sense but in practice, how are they going to do it? They can't use the word 'caution' and they can't explicitly say they're going to the sidelines.

My guess is that their hands are tied on the communication so they deliver something neutral. but because of expectations for a 'dovish hike', it will sound hawkish and USD/CAD will fall further.