Credit Agricole on EUR/CHF

Credit Agricole CIB FX Strategy Research notes that the G10 FX main beneficiaries of the latest development on US tax reforms are pairs such as USD/JPY and USD/CHF.

"A combination of both better risk sentiment and well supported Fed monetary policy expectations prove supportive. Please note too that the risk environment remains constructive, regardless of increased political uncertainty as related to Europe.

This in turn suggests that selling interest in low yielders such as the CHF high. This is fully in line with this week's risk index analysis," CACIB adds.

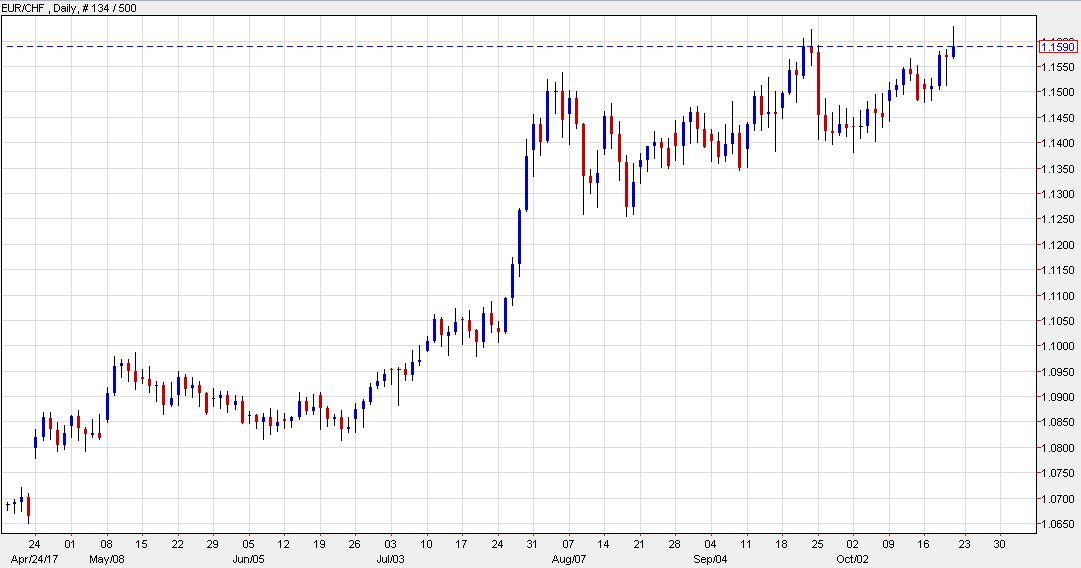

In line with this view, CACIB maintains a long EUR/CHF position from 1.1320 targeting a move towards 1.18.

For bank trade ideas, check out eFX Plus.