Reaction to the UK inflation report by Nomura analyst Jordan Rochester

He says that the bigger-than-expected fall in the inflation figures is "unlikely to rock the sterling trend but there may be some waiting to do for a dip to come before getting back in".

He adds that "balance this with good news of a transition being agreed yesterday, the Brexit news is more impactful".

In that lieu, Nomura is maintaining its call for a May BOE rate hike.

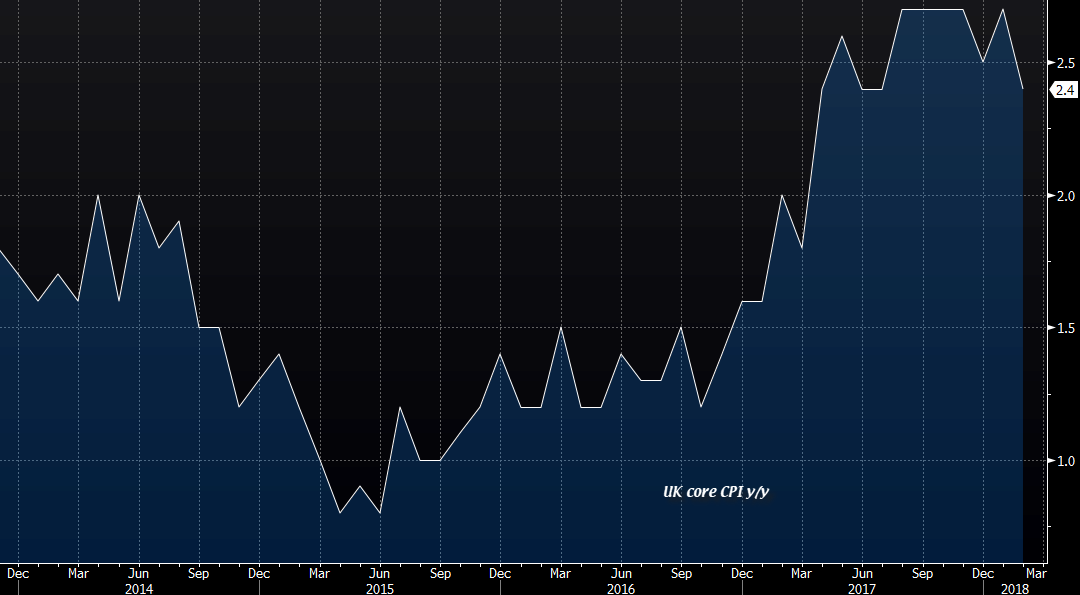

Well, the BOE's view that inflation has peaked at 3% is just about right it seems. Inflation staying at current levels would be ideal for a rate hike, but if the trend persists for a lower inflation just under 2% then you really have to wonder.

And that is only one part of the equation. Real wages still need to grow otherwise the decline in inflationary pressures would do almost nothing to help relieve the strain faced by UK consumers. And that is another headache for the BOE as well if they are to raise rates and further stretch consumer credit.