Forex news for NY trading on December 28, 2017.

- US stocks end the session with gains

- Bitcoin moves back down to test lows and bounces

- US treasury auctions off 7 year notes at 2.37%

- EURUSD extends toward the November high at 1.19605 level

- Forex technical analysis: GBPUSD moves back into post-Brexit "swing area"

- European stocks down again today

- DOE crude oil inventories come in at -4609K vs -3750K estimate

- EIA Natural gas inventories fell 112 Bcf last week

- Chicago purchasing managers index for December comes in at 67.6 versus 62.0

- Bitcoin trades back below the 200 and 100 hour MAs. More bearish

- Advanced goods trade balance for November $-69.7 billion vs -$67.9B

- US wholesale inventories for November 0.7% vs 0.3% estimate

- US initial jobless claims 245K vs 240K estimate

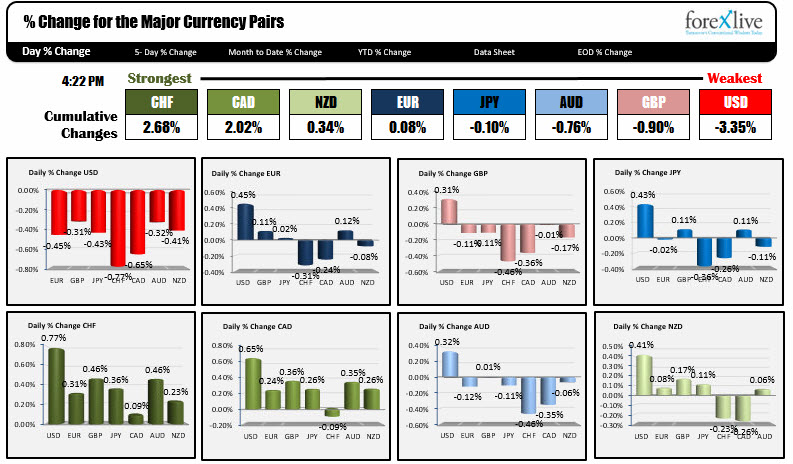

- The CHF is the strongest while the USD is the weakest currency as NA traders enter

- Reuters poll: Crude oil seen averaging $55.78 per barrel in 2018

In other markets near the close for the day:

- Spot gold followed the dollar and is ending the day higher by $7.74 or 0.60% at $1295.03

- WTI crude oil rallied up $0.26 or 0.44% to $59.90. The inventory data showed another greater than expected drawdown.

- US yield are ending the session higher. The 5 year rose the most. 2 year yield 1.903% up in basis point. Five year yield 2.295%, up 3.6 basis points. 10 year 2.4269%, up 1.6 basis points. 30 year 2.7515%, up 0.5 basis points

- US stocks rallied to close and are ending the day with gains. S&P index rose by 0.18%. NASDAQ composite index increased by 0.16%. Dow industrial average increased by 0.26%

The dollar fell in trading today. The largest moves were against the CHF and the CAD. The USD fell by 0.77% vs the CHF and 0.65% vs the CAD.

The USDCHF fell below support at the 0.9833-38 area (see earlier post) and trended lower into a support target at the 0.9775-78 area (the low reached 0.9772). Into the new trading day, the 200 bar MA on the 5-minute chart will be eyed at the 0.9800 area (and moving lower). Stay below and the sellers will remain in control. On the downside the 0.9775 level will need to be broken and remain broken. The move today seemed to be inspired by technical selling more than anything. That may have been inspired by the holiday trading.

For the USDCAD (the USD was lower by 0.65%), the pair fell below the 100 day MA at 1.26027. After the break, the sellers leaned against that MA line - keeping sellers more in control. The USDCAD has not traded below the 100 day MA since October 25th. Stay below that MA in the new day, keeps the sellers in firm control. A move above and traders will be lamenting the failed break.

The EURUSD broke above a trend line on the daily at 1.1910 area and trended to a high of 1.19585 (see post here). At the high, the price ran into resistance against the November high at 1.19605 level. Traders leaned against the risk defining level, and the price rotated back lower. We are trading at 1.1940 which was the old high from December - until today that is. The pair seemed to influenced by the flows today, and they were focused on the buy side.

The GBPUSD entered into the post-Brexit high area from 2016 at 1.34439 to 1.3532. The high reached 1.34555 but has backed off into the close and trades at 1.3440. I think traders will want to see more momentum above that 1.34439 level to get more excited about the topside. If it can not, the move higher from the Tuesday low at 1.3346, might see some backtracking.

In the wonderful world to bitcoin into the new day, the 100 hour MA at $14661 and 200 hour MA at $14778 was topside resistance. A move above is more bullish. On the downside, a floor at $13522 will need to be broken to give the crypto-currency the next push lower.

Happy New Year to all those in the Asian Pacific time zone. Peace, Joy, and Good Health to you and yours in 2018.