Forex trading news for June 22, 2017

- US stocks end little changed

- UK PM May: EU citizens currently in UK can stay in UK after Brexit

- BOE Forbes answers questions.

- US crude oil futures settle at $42.74, up $0.21

- Senate healthcare detractors start to line up

- Mexico central-bank raises rates to 7% from 6.75%

- BOE Forbes: Sees some urgency in raising rates

- Trump: Pleased to see healthcare bill move forward in US Senate. Wants bill on desk.

- Trump: I don't have any recordings of conversations with Comey

- It's a wrap. EU stock indices end the day mixed

- All my pictures of the Fed's Bullard have him making the same gesture

- Fed's Bullard: Projected rate path is 'unnecessarily aggressive'

- Kansas City Fed manufacturing index +23 vs -1 prior

- Saudi Arabia targeting $60 oil for Aramco IPO - report

- Nomura has a very bold call on the Bank of England

- US leading index for May +0.3% vs +0.3% estimate

- Eurozone consumer confidence hits the best level since 2001

- FHFA April US housing price index +0.7% vs +0.5% expected

- US initial jobless claims 241K vs. 240K estimate

- Canada April retail sales +0.8% vs +0.3% expected

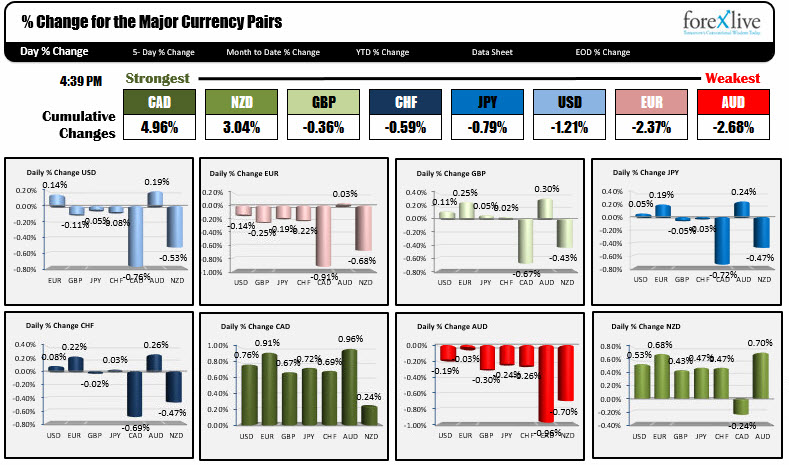

- The strongest and weakest currencies as NA traders enter for the day

A snapshot of other markets at the close shows:

- Spot gold up $3.70 or +0.30% to $1250

- WTI crude oil up $0.26 or 0.61% to $42.79

- US yields are down a touch. 2 year 1.3401%, -0.8 bp. 5 year 1.758%, -1.4 bp. 10 year 2.145%, down -1.7 bp. 30 year 2.714%, -1.2 bp

- US stocks ended the day near unchanged. S&P -0.05%, Dow -0.06%. Nasdaq up 0.04%

Another quiet economic day in the markets today. In the US, there was the weekly initial employment claims. No surprises there at 241k vs 240k estimate. Later in the US leading index for May was released. It rose for the 9th straight month, but when the Director of the Commerce Department says it is consistent with 2% growth in the US, and DT promised us 3%, that is a bit disappointing. The markets did not really react (in reality) to the report.

In other data in the NY session.

- EU consumer confidence came in at -1.3 vs -3.0. The story line there is even at -1.3, it was the best reading since 2001 (they should curve the consumer confidence numbers if -1.3 is the best since 2001. The people in Europe don't seem to be a very confident people).

- US housing price index was up a decent 0.7% in April (vs 0.5% est).

- The big data release came out of Canada. Retail sales in for April rose by +0.8% vs +0.3%. Moreover ex auto they were up +1.5% vs +0.7% estimate That was a market mover. The CAD rose sharply (the USDCAD tumbled). The USDCAD fell from 1.3304 to a low support level of 1.3208 before digging in a rebounding/consolidating.

Below is a quick look at the techicals starting with the USDCAD.

The USDCAD was sitting near a trend line, and near the 1.3300 level prior to the release. On the news, the pair broke below the 200 and 100 hour MAs at 1.3268 and 1.3260. The high corrective price after the first bottom came up to 1.3262, and from there sellers pushed the pair back down to support at 1.3208-11 (see yellow area in the chart below). That was a good place to bottom/take profits and the rebound began. In the new day the 100 and 200 hour MAs are now a topside line in the sand to stay below. The 1.3208 needs to be broken - and stay broken.

The GBPUSD traders took the day off today. My friends in London informed me that it was Ladies Day at Royal Ascot and I saw the temperatures were cooler as well. So my guess is the GBP traders were likely swilling champagne or Pimms and if they eyed a race, it would have been by accident. Topcoats, wild hats and bright colored dresses were the catalyst and focus for traders today and that meant a <40 pip trading range for the GBPUSD. In the NY afternoon, outgoing BOE member Kristin Forbes (obviously not a horse person) did speak hawkishly (nothing new), and it did help to take the GBPUSD toward its 100 hour MA at 1.2692 (the high reached 1.2690). However, the sellers came in and we are closing nearer 1.2680. In the new day, a move above that 1.2690 level would be a step in the bullish direction. ON the downside, the 100 day MA at 1.26318 will be eyed.

The EURUSD traders may have boarded the same train to races as well. That pair also had a quiet 39 pip trading range today. IN the NY session the price, moved below the 100 hour MA at 1.1161 in the first few hours of trading and up and downed its way to a low of 1.11388, before rebounding into the close. Going forward stay below the 100 hour MA, and the sellers have the most control. Targets come in at 1.1131 (low from last week) and 1.1118 (the low from the this week). If the 100 hour MA is broken (it is at 1.1159 now), the 200 hour MA at 1.11768 looms above. An hourly bar has not closed above that MA since June 13th (the Empire State Building looking day on the chart below).

For my very best on the AUDUSD you can read my post here....and can also find out about the USDJPY.

Hope you all have a great Friday (and weekend).

-----------------------------------------------------------------------------------------------------

The table below is a snapshot showing the changes of the major currencies vs each other. The CAD is the strongest today, while the AUD is the weakest.