Forex news for NA trading on January 18, 2018

- The major US stock indices are ending the session with small declines

- US House has the votes to advance the stopgap spending bill for debate

- Trump: Democrats want to shut down government to distract from tax cuts success

- WTI crude oil/Brent crude oil end the session with small losses

- IMF Lagarde: Current level of German trade surplus is not justified

- Forex technical analysis: EURJPY cracks below a trend line but 100 hour MA stalls the fall

- US Democratic Sen. Leahy will oppose another stop gap spending bill

- Bitcoin technical update: 100 hour MA stalled the move higher

- UK PM May: UK will remain steadfast partner to friends and allies after Brexit

- US sells $13B TIPS 10 year notes at 0.548%

- Fed's Dudley: Economy can grow at above trend rate

- Did your town make Amazon's shortlist for their 2nd headquarters?

- Recap: Coeure gives the euro a nice boost

- US Senators say they are considering very short-term stopgap bill

- Hackers have compromised more than 14% of Bitcoin and Ether supply

- The Atlanta Fed GDPNow estimate for 4Q growth rises to 3.4% from 3.3% last

- European stocks end the session with mixed results

- Trump warns US government could shut down

- US DOE weekly oil inventories -6861K vs -3150K expected

- Technical levels are defining the trading range for the AUDUSD

- IMF sees broad-based cyclical upswing in world economy, calls for cooperation on crypto

- Why Trump's fake news award is an incredible signal for markets

- Bitcoin rebounds into topside resistance targets

- Le Maire says joint French/German proposal on Bitcoin regulation to be presented to G20

- What's the next big opportunity in forex

- Canada December ADP employment -7.1K

- US initial jobless claims 220K vs 249K expected

- US January Philly Fed 22.2 vs 25.0 expected

- US December housing starts 1192 k vs 1275k exp

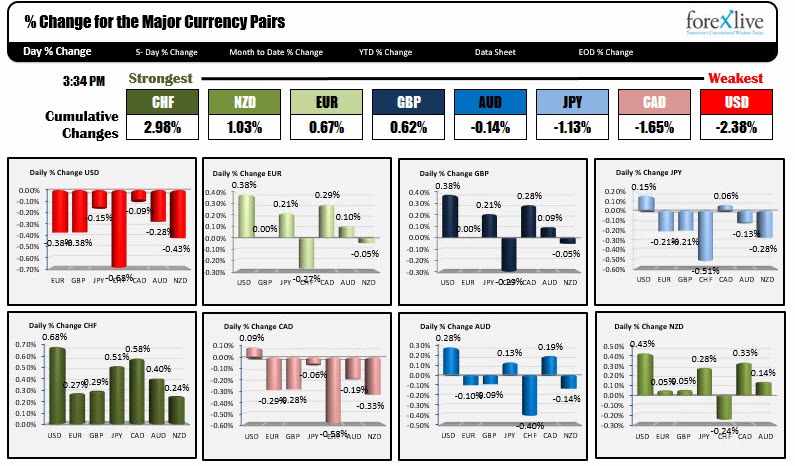

- The CHF is the strongest and the CAD is the weakest as NA traders enter

In other markets near the end of day:

- Spot gold is down $-.60 or 0.05% at $1326.40

- WTI crude oil futures are down $.21 or -0.33% at $63.76

- Bitcoin on Bitstamp is trading up $586 to $11,980. The digital currency is looking to test its 100 hour MA at $12,150.91. A move above in the new day will be more positive for bitcoin.

- US yields are higher on the day. The 10 year is trading above the 2.60% level. Two-year 2.043%, unchanged. Five-year 2.415%, up one basis point. 10 year 2.618%, up 2.8 basis points. 30 year 2.895%, up 3.8 basis points

- In the US stock market, the major indices are ending the session with losses with the Dow leading the way to the downside.

Yesterday, the dollar rallied modestly by the close after being lower earlier. Stronger stocks helped the flow into the greenback. Today was a different story. Coming into the NY session, the dollar was already showing signs of weakness. It was lower vs. all the major currencies with the exception of the CAD. By the end of the day, it was even lower and down against ALL the major currencies - even the loonies (see USD changes in the chart below).

The data in the US was mixed.

On the positive side was the initial jobless claims which fell to the lowest level since February 1973. That may have been a payback from the higher numbers seen over the turn of year period, but nevertheless was "record worthy".

The Philly Fed manufacturing index came in touch weaker at 22.2 versus 25.0 expectations, and US housing starts were also a bit on the light side at 1192K versus 1275K expectations. However, building permits were a bit better.

What was perhaps most disturbing for the dollar was the potential for a government shut down on Friday. As usual, the "man-hours" in Washington are being focused on various ways the government will avoid a shut down. Although there tends always to be some solution - after all who there wants to have that distinction on their resume - the risk remains.

Nevertheless, the price action in the NY session - although lower for the dollar - was modestly lower from end of the London morning session.

The biggest decline in the USD came against the CHF today.

Looking at the USDCHF hourly chart below, that pair has been alternating between going higher and lower all week. Today the high stalled against the high from Tuesday at 0.96648, and rotated right down to the lows from yesterday at 0.9572 (double bottom there). The NY session stalled and waffled back and forth off the lows. Traders in the new day will place their bets on a bounce back toward the upper extreme, or a break of the week's lows. Place your bets. The sellers are making the play but still have work to do.

In other pairs of interest:

- The USDJPY fell below its 100 hour MA on reports of a possible shut down, only to rebound and avoid a technical close below that MA level (it comes in at 110.82). The pair sits near the middle of the 100 and 200 hour MA. The 200 hour MA is up at 111.39 (and moving lower). The price has not traded above the 200 hour MA since January 9th.

- The EURUSD also toyed with its 100 hour MA in NY trading. That MA comes in at 1.2233 at the close of the day. The price is at 1.2240. Like the USDCHF, the EURUSD has seen it's share of ups and downs this week. The low (reached in trading today) stalled right at the 38.2% of the move up from the January 9th low at 1.2167. Also near that level is the 50% retracement of the range since the 2014 high at 1.2166. As we head into the new trading day (and going forward), that level is KEY for technical bias. Interim support before that level comes in at 1.2194 (swing lows from Tuesday and Wednesday on the hourly chart). If the 100 hour MA holds, and the price continues higher, the targets become the swing highs for the week (1.2282, 1.2296 and 1.23227). A break of the highest high would be the highest high going back to the end of 2014. So there is open road ahead.

- The GBPUSD stayed within the confines of yesterday's range, but did move higher on the day. Yesterday, there was a run up that saw the pair move up 120 pips in about an hour and 1/2. The high reached 1.3941. That remains the highest high since the Brexit. The 100 hour MA is lagging behind the current price by about 100 pips (it is at 1.3800 while the price is at 1.3890 at the close). So the buyers remain in control. It seems illogical the GBPUSD's rise in the face of Brexit concerns, but as long as the technicals remain positive (i.e. above the 100 hour MA), it is not wise to fight city hall.

Wishing you all the very best in your trading and for those in the Far East who are ending their trading week, have a happy and safe weekend.