Forex news for New York trading on November 16, 2017.

- US stocks surge with the Nasdaq closing at record levels

- A technical look at some major pairs as the day comes to a close

- UK Brexit Minster Davis: Putting politics about prosperity never smart choice

- White House economist Hassett: 4Q/2018 growth could be 3% or better. Gundlach disagrees...

- Cleveland Fed Mester: US Will hit 2% inflation sometime next year (not Q1)

- Saudi energy minister Al-Falih: We are committed to balancing oil markets

- More Kaplan: Emphasizes gradual, patient, careful removal of accommodation

- US House of Representatives passes tax reform bill

- Feds Kaplan: Sees 2% growth for US economy next year

- SNB Maechler: SNBs monetary policy remains expansive

- ECB Nowotny: Expects Euro recovery to go on for the next 2 years

- BOE Carney: If economy evolves in line with our projections, could see a couple rate rises

- ECB Smets: Low Inflation is not worrying

- A snapshot of the financial markets as the European stocks close for the day

- There is a rival for Bitcoin, and supply is limited.

- ECB Villeroy: ECB to clearly follow path of gradual normalization

- Bank of England Carney: households acting more in response to wage squeeze

- US NAHB housing market index for November 70 vs 67 estimate

- BOE Broadbent: lack of productivity growth is fundamental reason for low wages

- Feds Mester answers questions: gradual pace of rate hikes seeks to be balanced approach

- US industrial production for Oct. 0.9% vs 0.5% est. Capacity utilization 77% vs 76.3% est.

- ADP Canada Oct national employment report: Private sector jobs down by 5,730

- Philadelphia Fed business outlook for November 22.7 vs. 24.6 estimate

- Canada international securities transactions for September 16.81B vs. 9.85B last mo.

- US Oct import price index mm 0.2% vs 0.4% exp

- US initial jobless claims 249K vs 235K estimate

- Canada Sept mftg sales mm 0.5% vs -0.5% exp

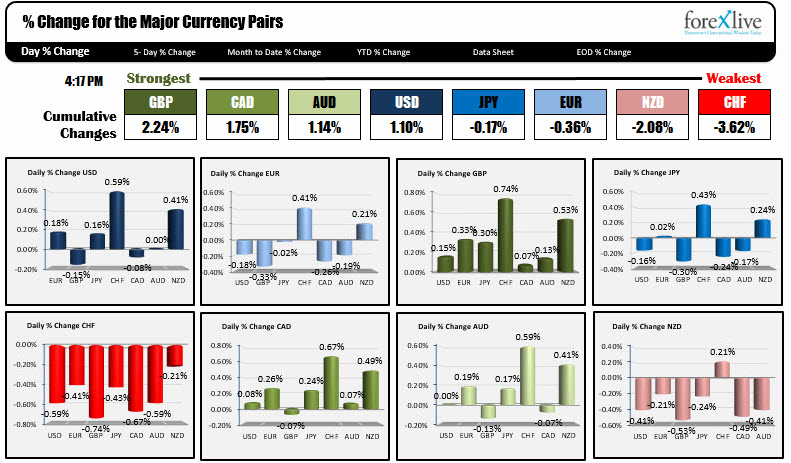

- The GBP is the strongest and the NZD is the weakest

- ForexLive morning news wrap: Euro retreat continues

A snapshot of other markets near the end of day shows:

- Spot gold of $.38 or 0.03% at $1278.50

- WTI crude oil futures down $.14 or -0.25% at $55.19

- US interest rates are higher. Two-year 1.708%, +2.5 basis points. Five-year 2.07%, +3.8 basis points. 10 year 2.37%, +5.1 basis points. Thirty-year 2.82%,, +6 basis points

- US stocks surged on the back of higher earnings from Walmart and Cisco and the passing of the house tax reform bill. S&P up 0.82%. NASDAQ up 1.3%. Dow industrial average up 0.8%.

The big news today (although expected) was the House of Representative passing of their tax reform bill. The Senate is next. They will have a tougher time as the margin of for victory is only 2 swing votes (assuming all the Democrats vote "nay"). The Senate vote will be taken after Thanksgiving. After that (and assuming passage from the Senate), the two bills go to committee before a final vote. It is hoped that the final bill can be signed into law by the President before Christmas. That is the best case scenario. The worst case scenario is it does not get to committee because of opposition in the Senate. Time will tell, but today was a good day for Rep Brady and House Speaker Ryan and the rest of the GOP members.

On the economic front, the Initial jobless claims were higher than expectations at 249K versus 235K estimate. The data is still being impacted by hurricanes.

The Philadelphia Fed business outlook index was lower than expectations of 22.7 versus 24.6. US import price index rose by a smaller than expected 0.2% versus 0.4%. Finally industrial production capacity utilization were greater than expectations (IP rose 0.9% vs 0.5% estimate and Cap. Util. 77.0% vs 76.3%). However, they were influenced also by the hurricane in a positive way (+0.6% for Industrial production).

The best data came out of Canada with Manufacturing sales coming in much better at +0.5% vs -0.5% estimate.

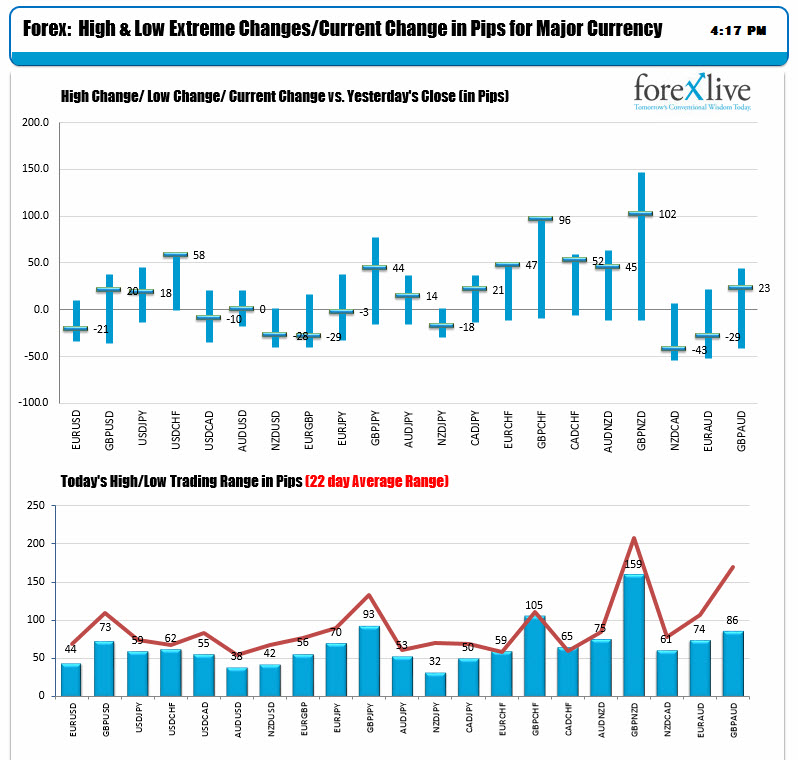

The US news did not have that great an impact on the USD dollar in the NY session. Yes prices moved up and/or down, but apart from the USDCAD which extended its range by 25 pips vs the NY opening (as a result of the much better Manufacturing sales data), and the USDCHF which extended by 10 pips (the CHF pairs are trading at extremes into the close), the trading stayed within the high low range set by Asian and London trading for the rest of the major currency pairs. In fact all the major pairs against the USD, and major crosses failed to reach their 22-day averages (see lower chart below).

The greenback was mixed, with gains vs the EUR, JPY, JPY and NZD and losses against the GBP, and CAD. It was unchanged vs. the AUD.

For the day the strongest currency was the GBP while the weakest was the CHF.

Toward, the close I did outline the technicals for some of the major pairs including the USDCAD, USDJPY, EURUSD and GBPUSD. You can find my thoughts for those pairs, but CLICKING HERE.

For those traders in the Far East who will call it a day at they end of your shift, let me wish you all a great and safe weekend. And for all traders, good fortune with your trading.