Forex news for NY trading on January 11, 2018.

- US stocks end the day at highs. Strong gains. Record levels.

- More from Dudley: forecast for 3 rate hikes this year a reasonable starting point

- Fed's Dudley: Strong case to to keep gradually raising rates

- Capital One raises minimum wage to $15/hour

- Crude oil futures settle at $63.80 up $0.23

- US Treasury Sectretary Mnuchin: Expects NAFTA will be renegotiated

- Bitcoin swings above and below shorter term MAs

- US December budget deficit at $23B vs $40B exp

- CNBCs day at a bitcoin miner. What are some of the facts at this miner.

- USDJPY moves to new day lows. Looks toward 111.00 target

- Senator Jeff Flake says that there is a bipartisan "deal on immigration"

- US sells 30-year bonds at 2.867% vs 2.900% WI bid

- Audio recap: No love for the US dollar

- Trump is bringing a full delegation to Davos with him

- ECB says banks should adopt a conservative 2017 dividend policy

- European stock indices close with mixed results

- US government to sell 3813 Bitcoin via auction later this month

- Bitcoin moves off double bottom. Buyers back in it but resistance looms.

- The oil rally continues as WTI hits the highest since December 2014

- Ripple jumps 27% after MoneyGram announces test

- Canada foreign min: US said from the start they might pull out of NAFTA

- Bill Gross: Bonds are in a bear market

- Wal-Mart boosts starting wages, pays bonus, expands benefits

- Philly Fed December numbers revised generally higher

- Canada Nov new housing price index +0.1% vs +0.2% exp

- US initial jobless claims 261K verse 245K expectations

- US December PPI -0.1% vs +0.2% expected

- ForexLive European FX news wrap: Dollar holds firm while sterling slides late on

A snapshot of markets at the close of day is showing:

- Spot gold up $5.46 or 0.41% at $1322.42

- WTI crude oil futures are trading in after-hours markets unchanged at $63.56. The price is down from a high of $64.77. For a typical look at the WTI contract, CLICK HERE.

- US major stock indices closed at record levels and near session highs after a late day surge. The S&P index rose 0.7%. The NASDAQ composite index rose 0.81%. The Dow industrial average also rose by 0.81%

- The US treasury auctioned off thirty-year bonds and for the 3rd auction in a row this week, the demand was strong. As a result, yields fell. China may say they don't see value in the US debt market - and perhaps in relation to inflation the yields are low. However, with alternative government debt around the world at much lower levels, a yield of 2.86% in the thirty-year bond is quite attractive. Two-year 1.9766%, unchanged. Five-year 2.322%, -0.6 basis points. 10 year 2.535%, -2.2 basis points. Thirty-year 2.8665%, -3.2 basis points

- European stock markets ended the session mixed. German DAX fell -0.6%. France's CAC fell -0.3%. UK's FTSE rose 0.2%. Spain's Ibex rose 0.07%. Italy's FTSE MIB rose 0.64%

The NY session got going early with a move higher in the EUR. The catalyst were some hawkish comments in the minutes of the ECB meeting.

An hour after that new, the US PPI data and initial jobless claims both came out weaker than expectations. That helped to send the USD lower.

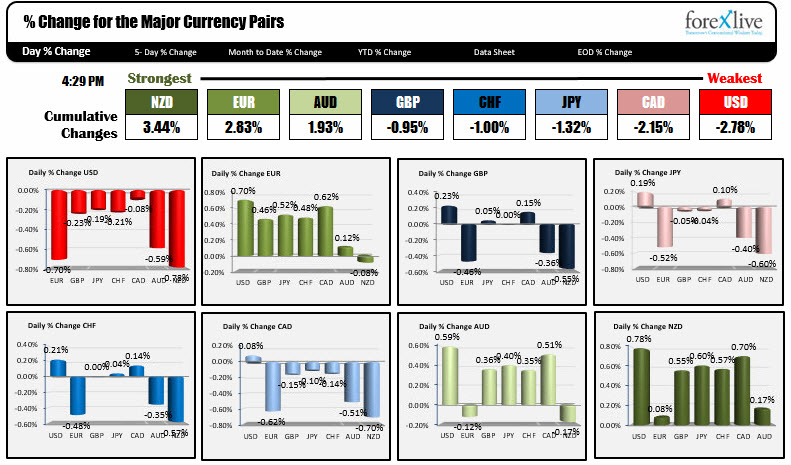

Those two events set the stage for the markets and at the end of the day, the EUR is ending as one of the strongest currency (the NZD actually overtook it at the end of the day), while the USD is the weakest (see snapshot of the gainers and losers in the chart below).

In other news, the NY Fed President William Dudley, spoke and commented that there is a strong case for the Fed to continue to raise rates in 2018 (see 3 hikes) as the tax cut should stimulate growth in the short term. However, he is not so optimistic on future growth citing concerns about the US deficit from the same tax cuts.

What are some of the charts saying?

As mentioned the EURUSD shot up on the minutes of the ECB. That move took the price above the 100 hour MA at 1.1972 and the 200 hour MA and 50% retracement at 1.2002 area. That level acted as a base early in the NY session and propelled the pair up toward the underside of a broken trend line on the hourly chart at 1.2062. The high reached 1.2058 and the price rotated lower into the close (closing near 1.2033). Technically, the rise back above the 1.2000 level (200 hour MA and 50% retracement), put the buyers back in full control. That level is the risk level for bulls now. Remember there is a double top at 1.2088-92 with the 1.2088 the 2018 high and the 1.2092 the 2017 high (only 4 pips separates them). If the buyers are now in control, that should be a target going forward.

The USDJPY was another pair that reached a key target in trading today. The 111.02 was the 50% of the move up from the September 2017 low. The low price today moved down to 111.03. We are trading at 111.23 at the start of the new day. The 111.26 was the low yesterday. If the pairs bottom is in place, getting above that is step one, but be aware the 111.70 is where the 200 day MA is found. That will be a tougher nut to crack on more upside. If the bears are not done, a move below the 111.00 will be a catalyst for more sellling now. Battle on near 50% support level.

The GBPUSD traded most of the NY session (after a run higher in sympathy with the EURUSD) wafflling above and below the 100 and 200 hour MAs at 1.3534 and 1.3541. The "market" is pausing and waiting for the next push. The market will make a decision in the new day. Look for a move and momentum.

The USDCAD moved up to its 100 day MA at 1.2590 and stopped. Yesterday it broke above its 200 hour MA at 1.2490 and later used that level as support. The price may stay between that 100 pips between now and the BOC decision on January 17th. For a look at the charts and more detail, CLICK HERE.

The AUDUSD got it's push nearly 24 hours ago (well a little less) after the better than expected retail sales report. For most of the NY session the market waffled below resistance at the 0.78868-97 area. Late in the day, there was a little move higher and the pair sits between those two extremes. Can the new day kick the price above that key resistance area? That is what traders will be looking for. If not we could see an end of week rotation back lower.

My technical views on Bitcoin can be found HERE and more recently HERE. In short the digital currency bounces off the 2018 low nicely, but the momentum higher stalled and the price started to come back down. Technicals continue to play a major part for traders. Ignore them at your own risk.

For those in Asia-Pacific who are trading their Friday, have a good weekend. For others who will join myself and Adam tomorrow, until we meet again at that time.