Forex news for the European morning trading session 14 Nov 2017

News:

- US Fed's Kaplan "actively considering" Dec rate hike

- US Fed's Evans says they need to prepare public for unconventional policies

- BOE's Carney would like a reasonable transition period post-Brexit

- Yellen says Fed is aware it needs tools to cope with negative shocks

- BOE's Carney says cultural change needed in communication from institutions

- More from Yellen: So many Fed voices speaking may be confusing

- Fed's Yellen says all guidance should be conditional on outlook

- ECB's Draghi says forward guidance has become a full policy instrument

- BOJ's Kuroda says inflation expectation formation largely backward looking

- Trump not attending East Asia leaders summit

- China's Li calls for advancing free trade agreement with Japan and South Korea

- OECD sees robust Emerging-Asia economic growth at 6.3% 2018-22

- IEA cuts 2017 oil demand growth forecast by 100k bpd to 1.5 mln bpd

- Reuters poll - economists expect Japan wage rises next year below PM Abe's target

- Australia Q3 Wage Price Index is due Wednesday - preview

- Forex option contract expiries for today 14 Nov

- Trading ideas for the European session

- Nikkei 225 closes near enough unchanged at 22,380.01

- ForexLive Asia FX news wrap: AUD/NZD a big mover

Data:

- UK Oct CPI mm 0.1% vs 0.2% exp

- Germany Q3 GDP provisional qq 0.8% vs 0.6% exp

- Germany Nov ZEW current situation 88.8 vs 88.0 exp

- Eurozone Q3 GDP revision 0.6% as exp

- Italy Q3 GDP provisional QQ 0.5% vs 0.4% exp

- US NFIB Oct small business optimism 103.8 vs 104.0 exp

- Spain Oct CPI mm final 0.9% as exp

- Switerland Oct producer and import prices mm 0.5% as prev

A mostly steady session but not without opportunity and one which has seen the euro take line honours.

It wasn't long before we saw a regular move in EURGBP heading up and pushing GBPUSD lower but that euro demand was suddenly magnified by a spike in EURUSD to test 1.1700 having formed a decent base at 1.1665 .

Highs so far as I type of 1.1728 after wiping its feet around 1.1700 but EURGBP has needed little encouragement to post 0.8956 so far helped by weaker UK inflation data that also saw GBPUSD dip back into 1.3085 having rallied back above 1.3110 from earlier lows.

Plenty of CB rhetoric but none of real impact and that's meant that other pairs have largely been well behaved.

USDJPY did have a rally from 113.65 to look at 114.00 but fell short at 113.91 as large option expiries played out, and yep, we've gone back to the start. Expiries at 0.7650 also helping to temper AUDUSD gains .

USDCHF has been on the back foot as EURUSD rallies and EURCHF holds steady while NZD has continued to show a few losses. USDCAD has retreated from 1.2750 to 1.2730 on general USD softer tones.

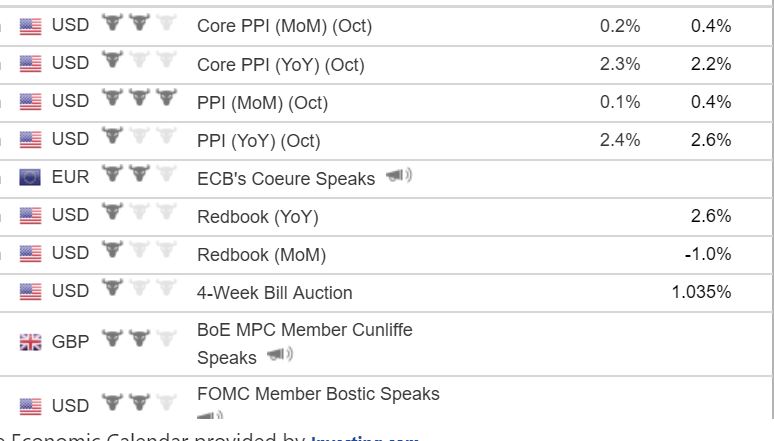

US PPI at 12.30 GMT and CB talking heads on the agenda to come.