Forex news for the European morning trading session 1 Dec 2017

News:

- Merkel and SPD to start talks on forming coalition

- SPD's Schulz says Germany's European policy must change

- More from Schulz: I have not given green light for another SPD/Conservative coalition

- What are the odds of a Fed hike this month?

- Fed's Mester: Expects long rates to rise with Fed's gradual hikes

- Fed's Dudley: It's probably not the best time for fiscal stimulus

- BOF's Villeroy says Bitcoin is just a speculative asset

- Ireland's Coveney: Wants to agree wording with UK to avoid a hard border on Ireland

- A reversal in fortunes among the major FX bloc

- Forex option contract expiries for today 1 Dec

- Reuters poll: BOE only expected to raise rates in Q4 2018

- Reuters poll: RBA cash rate seen at 2% by June 2019

- What's causing a drag on the AUD?

- EUR/CHF hits highest level for the year. What to look out for?

- Oil markets need not be afraid - GS

- PBOC issued 404bln yuan via MLF in Nov

- Trading ideas for the European session

- Nikkei 225 closes up +0.41% at 22,819.03

- Forexlive Asia-Pacific news wrap: Japan employment/cap ex good, inflation...meh

Data:

- Italy Q3 final GDP +1.7% vs +1.8% y/y expected

- UK Nov manufacturing PMI 58.2 vs 56.5 expected

- Eurozone Markit Nov PMI final 60.1 vs 60.0 exp

- Germany Nov manufacturing PMI final 62.5 vs 62.5 expected

- France Markit Nov mftg PMI final 57.7 vs 57.5 exp

- Italy Nov manufacturing PMI 58.3 vs 58.5 expected

- Spanish Nov manufacturing PMI 56.1 vs 56.5 expected

- Switzerland Nov mftg PMI 65.1 VS 62.5 exp

- Australia Nov commodity index AUD terms 125.6 vs 122.9 prev

- Japan Nov vehicle sales -5.4% vs -4.7% y/y prior

The start of a new month and the pattern is the same as seen in recent sessions. Mixed, fragile and lively with traders still scratching their heads.

EURUSD and GBPUSD had both had another look at 1.1930 and 1.3550 in Asia but once again ran out of puff and we've since been back to 1.1883 and 1.3480 in a rinse and repeat play that has produced a few pips lately for those not too greedy or ambitious.

GBPUSD 15m

EURUSD 15m

EURGBP had a quick look at 0.8800 early doors but then spiked up to 0.8835 before retreating back in equal time and as usual those moves have had the inverse impact on GBPUSD.

Final EZ area PMI data lent little support as the German coalition saga played out to the extent that the DAX fell to 9-week lows.

USDJPY remains underpinned but some option expiry interest around 112.65 helping to cap while USDCAD also has interest at 1.2850 again and that's proved a good support point sending the pair back to 1.2880 despite oil firming.

USDCHF has traded down to 0.9816 from 0.9835 but also has option-led support at 0.9800 helping to put a bid under the pair and EURCHF which has also noted losses.

AUDUSD found some support into 0.7550 again after failing at 0.7600 again in Asia while NZDUSD has made gains from 0.6820 to 0.6857.

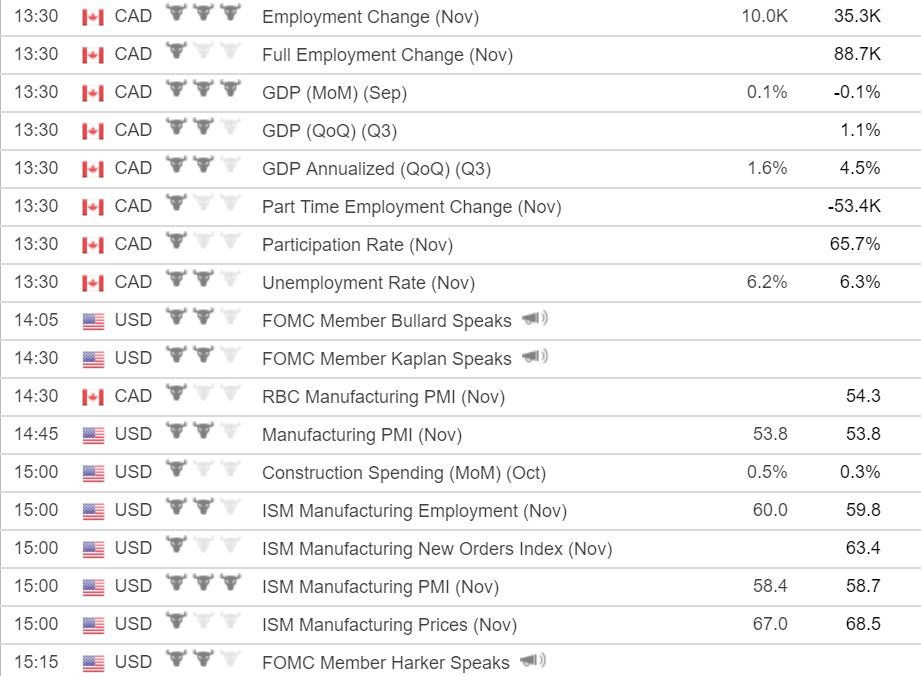

A busy data/Fed head slate on its way to throw into the fragile mix.