Forex and Bitcoin news from the European morning trading 6 Mar 2018

News:

- North Korea open to frank talks with US for denuclearisation

- Bitcoin in retreat again but dip buyers poised

- If you're interested in mining Bitcoin, then Venezuela is the place for you

- Coinbase accused of insider trading by its customers

- European Commission says EU has right to take retaliatory measures against US imports

- EU is said to mull tariffs on US steel, denim, bourbon - Bloomberg

- Goldman Sachs says Trump has likely created a two-tier metal market

- Le Maire says UK financial services sector can not be in a free trade deal with EU post-Brexit

- It wouldn't hurt to brace yourself for a Trump response on the trade front

- BOJ's Kuroda clarifies comments from Friday regarding BOJ exit strategy

- BOJ's Kuroda says that easing policy exit will be gradual

- BOJ's Kuroda says that central bank needs to continue powerful monetary easing

- More from Kuroda: Impact of 2019 sales tax hike may be smaller than prior one

- BOJ's Kuroda says less stimulus is unthinkable before reaching inflation target

- BOJ's Kuroda says that it takes some time to change deflationary mindset

- RBA leaves cash rate unchanged at 1.50%

- RBA March monetary policy decision - here is the full statement

- Three reasons the ECB should not change its guidance this week

- Riksbank's Ingves expects krona to appreciate slowly

- Riksbank's Ingves repeats it's important that krona doesn't rise too fast

- A mixed bag in the currency market so far today

- USD/JPY falls to session low, slips below 106.00

- AUD/USD upside move stalls at key resistance level

- Nikkei 225 closes higher by 1.79% at 21,417.76

- ForexLive Asia FX news: Yen loses a few tics today

Data:

- Eurozone February retail PMI 52.3 vs 50.8 prior

- Switzerland February CPI m/m +0.4% vs +0.3% expected

- Germany February construction PMI 52.7 vs 59.8 prior

- South Africa Q4 GDP qq SA 3.1% v 1.8% exp

A scrappy session that's seen early yen demand reversed on hopes of a level of peace between US/NK. Equities have been mostly in positive mode but Bitcoin/cryptos have run into a another round of selling.

In this ever fickle world of forex we've seen the biggest single day drop in DXY since 15 Feb with USDJPY down to 105.85 but then bounce back to 106.47 in rapid fashion on the NK news. That has accelerated rallies elsewhere in core pairs that had previously been climbing gently on the general USD supply.

EURUSD has large option interest 1.2300 and that lent support around 1.2330 and we've been up to 1.2404 while GBPUSD has also caught a bid and posted 1.3906 from 1.3825 with GBPJPY leading the way to 147.90 from lows of 146.60.

A similar theme across the board with AUDUSD up to 0.7818 from 0.7762 with AUDJPY 83.12 from 82.20. USDCAD failed at 1.3000 again and with CADJPY demand returning has fallen to post 1.2930.

USDCHF has fallen to 0.9380 but still finding some risk-on support with EURCHF up to 1.1632.

Bitcoin failed above $11600 and fallen back through $11000

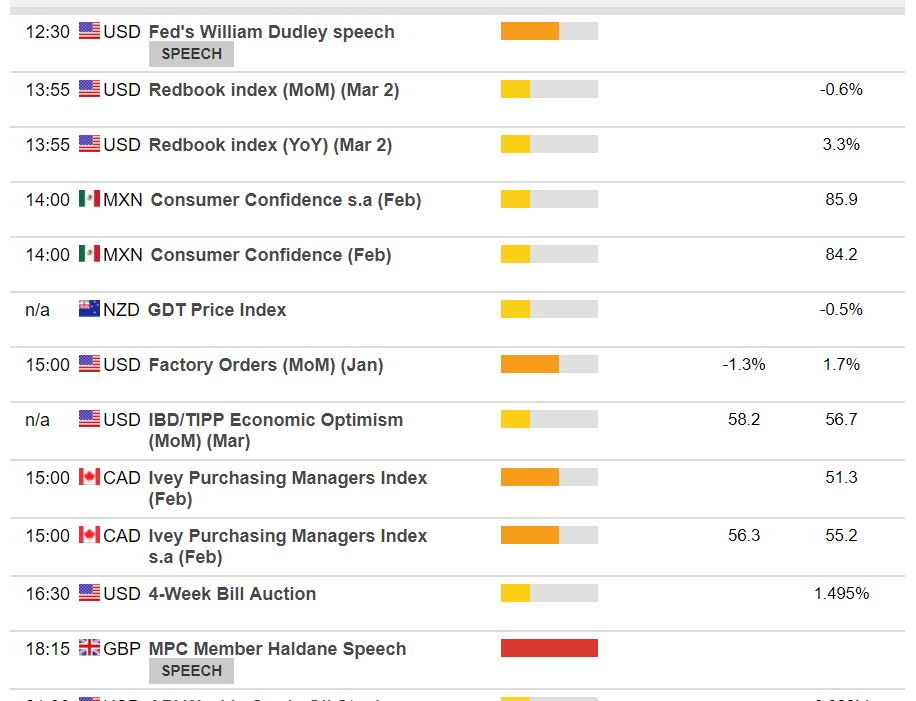

US Fed's Dudley speaks at 12.30GMT and here's the data to follow in the NA session: