Forex and cryptocurrency news from the European morning trading 21 Mar 2018

News:

- FOMC coming up on Wednesday - all the previews in one place

- Fed says FOMC to proceed as planned despite winter storm

- Deutsche's Goel sees FOMC median dots shifting higher

- BofAML says that FOMC risk is skewed towards a bullish USD

- FX option expiries for the 14.00 GMT cut - 21 March 2018

- ECB's Smets says they think slack could be larger than expected

- EUR/GBP continues to track lower following UK labour market report release

- German 2018 GDP growth forecast raised to 2.3% - report

- UK's Fox says London will remain dominant in financial services post-Brexit

- South Korean parliament endorses BOK's Lee reappointment

- Danske sees EUR/CHF heading to 1.18 in the short-term

- EURUSD orders 21 March - Large option interest in play again

- Dollar loses further ground on the day

- Germany's IFO says trade tariffs and euro appreciation weighing on business sentiment

- Switzerland February M3 money supply y/y +3.7% vs +4.1% prior

- Australian government releases the first issue of its Industry Insights publication

- USDJPY orders 21 March - Someone's pressed the pause button ahead of FOMC

- Trading ideas for the European session 21 March

- BOK's Lee says current level of interest rates is accommodative

- UBS says that deficits will weigh on the US dollar

- Oil's breakout sees it close in on three-week highs

- South Korea to hold a high level meeting with North Korea on 29 March

- Kiwi not feeling the love from its aussie counterpart either

- China reiterates that there is no winner in trade wars

- USD/CAD finds support after a dip from reported progress in NAFTA talks

- NZD/USD trades at two-month lows, what next?

- ForexLive Asia FX news: CAD gains on NAFTA news

Data:

- UK Jan average weekly earnings 3mth-yr 2.8% vs 2.6% exp

- UK February public sector net borrowing -£0.3 bn vs -£0.5 bn expected

Understandably a steady session overall range wise as the US Fed FOMC announcement holds sway but also with large option expiry interest playing out on EURUSD, USDJPY and GBPUSD.

USD selling has been generally notable and sent USDJPY down from 106.50 through one line of support/demand at 106.30 only to fail at the next one around 106.20. EURUSD meanwhile had also found good option related support at 1.2250 to post 1.2291 and GBPUSD from 1.4020 to 1.4075 helped by some decent UK wages/jobs data.

USDCHF remains underpinned but has fallen back from 0.9550 to 0.9520 while USDCAD has fallen from 1.3060 to 1.3003 on a double whammy of oil price rally too.

AUDUSD has had another soggy session and failed above 0.7700 to drop and test 0.7680 demand/support again while NZDUSD also remains on the back foot.

Gold, like oil, has also rallied but retreated too from $1318 while equities have traded with softer tones.

Bitcoin has continued its recent rally to clear $9000 from $8500 and remain underpinned.

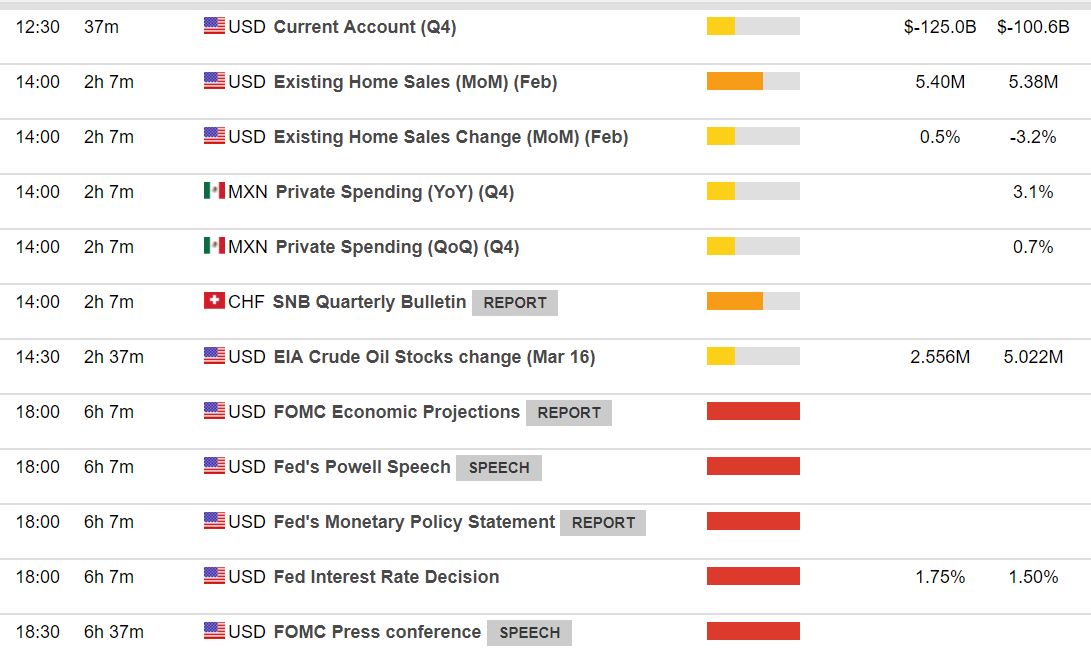

Data coming up at 12.30 GMT but it's the FOMC that steals the spotlight at 18.00 GMT