Forex trading news for Asian-Pacific traders on December 1, 2017

- More on the Bank of Korea's interest rate increase

- North American oil producers to benefit after OPEC extends output cuts - Reuters

- Forex technical analysis: GBPUSD failed after reaching a new week high

- Deficit concern the stumbling block in tax overhaul - WSJ

- Forex technical analysis: USDCAD down on the day. Moves toward trend line support

- Caixin China Mfg PMI for November 50.8 vs 50.9 estimate

- PBoC sets Yuan midpoint at 6.6067 against the dollar

- Dollar moving a lower. Senate vote delay impacting the greenback

- U.S. Senate will not vote on Republican tax bill on Thursday

- Markit/Nikkei manufacturing PMI revised to 53.6 from 53.8

- Japan capital spending for 3Q y/y 4.2% vs. 3.2%

- Japan jobless rate for October 2.8% versus 2.8% expected. Equals the lowest level since 1993

- Japan headline National CPI (October) 0.2% YoY vs. 0.2% estimate

- GOP Senator Perdue: Senate Republicans are weighing future tax increases to "trigger"

- Traders in the EURUSD keep an eye on the 100 hour MA today

- AiG performance of manufacturing index for November 57.3 versus 51.1 last month

- The results are in for Thursday and the GBP was the big gainer, while the NZD was the big loser.

- CBA Australia PMI manufacturing for November 56.3 versus 55.5

- New Zealand's terms of trade index for 3Q 0.7% vs. 1.3% estimate

- A quick technical look at bitcoin. Intraday sellers trying to keep control (for now)

- US stock indices surge. Dow and S&P close at records.

- ForexLive Americas FX news wrap: Dollar drops and then rebounds

A snapshot of other markets at the Asian Pacific new wrap shows:

- Spot gold is trading near unchanged at $1274.87. The low to high range has been contained with the high reaching $1276.86 and the low extending to $1274.02

- WTI crude oil is trading up $0.17 or 0.30% to $57.57. The high to low range was only $0.37 with $57.66 the high and $57.29 the low

- In Asian stock markets: S&P/ASX is trading up 19.30 points or +0.32%. The HK Hang Seng is down -38.61 or -0.13%. The Shanghai composite is lower by -11.63 or -0.35%. The Japan's Nikkei 225 is up 72.59 points or 0.32%

- US 10 year yield is trading at 2.406%, down a fraction of a bp from the close yesterday.

The Asian Pacific session had a bunch of data released, but the impact was quite frankly, limited.

Japan had employment and inflation come out and one - employment - showed decent strength. The unemployment rate is dragging along the lowest level since 1993 and the Job to applicant ratio was the highest since January 1974 (yes...1974 - see post here). In contrast to that data was CPI inflation which remains well below the oft talked about 2.0% BOJ target. Both the headline and ex food and energy came in at 0.2%. Although, the numbers were not any worse than expectations, they still are not all that great - and remain well off the BOJ target..

Capital spending in Japan was also released and it was good at +4.2% for the 3Q but company profits and sales were weaker than expectations.

The story line of "If only inflation would kick in" remains the same, but it remains stuck in the mud despite expectations for decent growth.

The USDJPY fell to the 38.2% of the move up from yesterday at 112.32 before moving back higher. We trade higher by about 8 pips after all the dust has settled.

In other data today, the New Zealand terms of trade came in weaker than expectations for the 3Q at 0.7% vs 1.3% estimate. The NZDUSD move to a new low for the week at 0.6816, but bottomed and recovered up to 0.6840 before heading back lower in the down and up and down session. We currently trade at 0.6827 which is a few pips lower from the close yesterday.

The Caixin China Mfg PMI came in a touch weaker at 50.8 vs 50.9 estimate. Although above 50, the reading was the lowest in 5 months and the confidence reading was one of the weakest since 2012 according to comments.

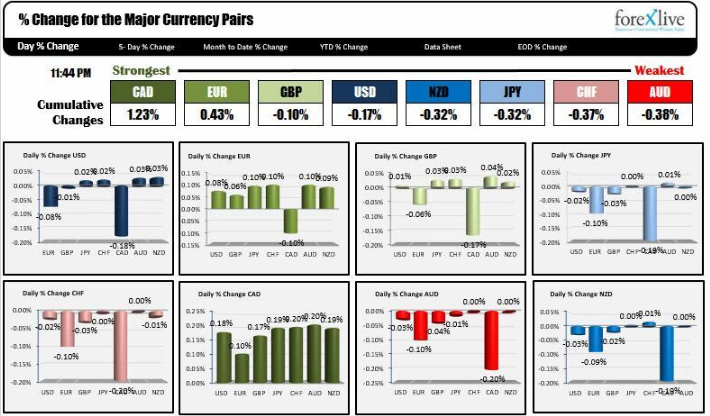

Overall for the session, the CAD was the strongest of the majors, while the AUD was the weakest. The CAD fell after the high in yesterday's trading could not get above end of October/beginning of November highs at 1.2909/14. In the North American session, the Canada employment numbers will be released along with GDP. This week the USDCAD moved up on each day. A little correction lower is not all that surprising as traders lighten up. For the technical view, CLICK HERE.

In other technical stories as the market transitions into the European session:

- The EURUSD bounced off the 100 hour MA at the 1.1884 area (low reached 1.1886). The pair is trading at session highs at 1.1915 and looking more bullish (CLICK HERE).

- The GBPUSD made a new week high and traded at the highest level since September 25th in early Asian Pacific trading . That is the good/bullish news. The not so good/bullish news is the high was only 1 pip higher than yesterday's peak. That aint so great. So the price rotated back lower. The pair sits on an edge wondering if the next push is more corrective lower after the run up this week on the back of EU news, or does the price find a floor and run higher? For a technical look, CLICK HERE.

That's it for me. I somehow made it through the week with 2-3 screens (normal is 6). I get some new hardware over the weekend and look forward to being at full strength (fingers crossed) next week (what a time for Eamonn to take off). I thank you for your patience.

Wishing you all a great and safe weekend. Have fun.