The yen has surged the past 2 days, the catalyst that kicked it all off was the Bank of Japan reducing its JGB purchases size:

- Bank of Japan cuts its purchases of JGBs today

- USD/JPY selling off - follows BOJ reducing JGB purchase amount

- 'Minor tweak' from the BOJ and the yen gain, but just wait until the real thing

- The spike in JPY today only a taste of what is to come when the BOJ removes stimulus

This links are all from Tuesday, I posted further on it yesterday:

- USD/JPY on the move again, close to its overnight lows now

- And now a word from Albert Edwards ... possible BOJ surprise tightening

- ForexLive Asia FX news wrap: Yen gains a little more

Positioning (extreme yen shorts) has been a big factor, in some of those posts (above) I highlighted where stop loss USD/JPY sellers were placed.

This now from Commerzbank on the Bank of Japan and yen (from an overnight note) (bolding mine):

- Japanese yen once again continues the appreciation trend seen over the past few days.

- The reason is a recent rise in speculation that the Bank of Japan (BoJ) might tighten its monetary policy this year. This speculation was further fuelled ,,, by the central bank's announcement to be buying fewer long-dated government bonds as part of its asset purchasing programme in the future. Both yields and JPY went up significantly as a result.

- As we have been pointing out for some time at this juncture the market participants' hopes are premature in our view.

- Of course, the positive economic and global environment seem favourable for the start of a monetary policy normalisation. However, the continued low levels of price pressure in Japan in our view clearly make an early end of the expansionary BoJ monetary policy unlikely.

- The central bankers not simply set themselves the target of reaching the inflation target of 2% but so as to anchor inflation at this level they even want it to overshoot the target for some time. With a current inflation rate of 0.6% the central bank is still a long way off that though.

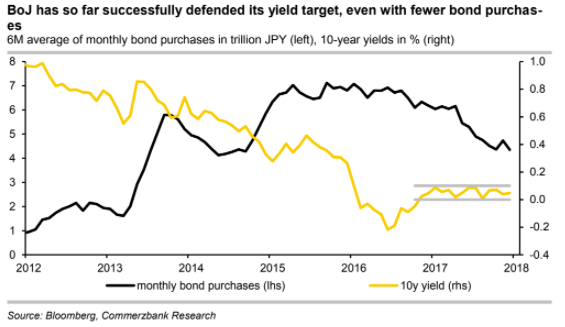

- Moreover the reaction to yesterday's announcement on the part of the BoJ is a complete misinterpretation in our view. After all the BoJ has been tapering its asset purchases for some time, to be precise ever since it changed over to its strategy of yield-curve-control. As a result the focus no longer rests on the volume of the asset purchases but on defending a yield target - for 10-year bonds this stands at roughly 0%.

- BoJ governor Haruhiko Kuroda has pointed out repeatedly in this context that it is quite possible that the BoJ will have to buy fewer bonds to reach this target. What is more, the central bank has proven repeatedly in the past that it takes this target very seriously. Since the introduction of the yield-curve-control strategy it has prevented the yield for 10-year bonds from rising above 0.1% on a sustainable basis (see chart). Every time the yield risked rising above this level it held an auction in which it offered to buy an unlimited amount of bonds. In our view the BoJ has thereby underpinned the credibility of its strategy. Our position thus remains unchanged: The BoJ will remain one of the most expansionary central banks for some time yet, so that the prospects for JPY are far from rosy.

---

While the BOJ action kicked off the move, its positioning (unwinding of) that has seen it extend. The prospect of a change in policy from the Bank of Japan is still a long way off. While momentum traders are being presented with rewarding trades, yen bears are being presented with good levels to get back in.