Australian employment figures for December are coming up at at 0030 GMT

I posted a couple of previews already:

This one now, via Westpac:

- Total employment rose 61.6k compared the market's 19k forecast and Westpac's +25k. It was the 14th consecutive gain monthly gain in employment matching the historical second longest period of monthly gains which started Aug 1979. The longest period of consecutive employment gains is 15 months starting May 1993.

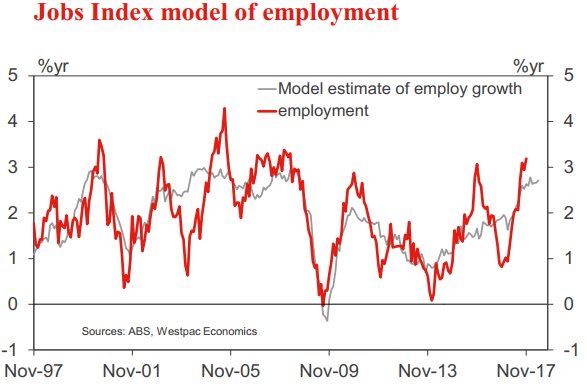

- The Australian labour market gathered momentum through 2017 with annual employment growth accelerating from 0.9%yr in February to the November peak of 3.2%yr. In the year to Nov total employment has grown 383.3k.

- The pace of employment growth overshot Westpac Jobs Index which is suggesting growth of around 2¾%yr. The Jobs Index is not pointing to a downturn, however, growth is likely to ease back from the +3%yr pace. Westpac's -10k forecast will see it ease to a 2.9%yr pace.

More:

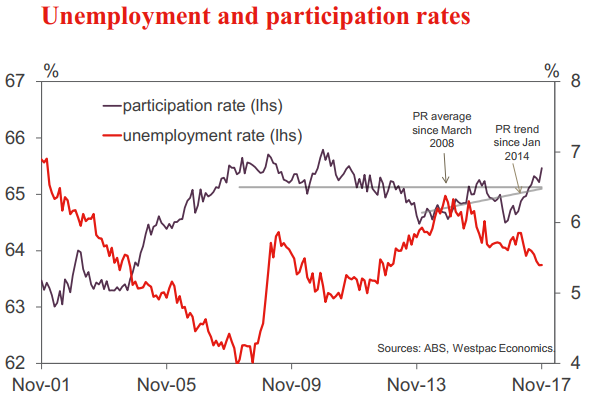

- In November the unemployment was flat at 5.4% (5.40% at two decimal places vs. 5.39% in October) with a 0.3ppt gain participation driving 65.7k surge in the labour force.

- In the November survey the ABS noted that the incoming rotation group had a higher employment to population ratio than both the group it replaced and the entire sample. As such, sample volatility would explain a fair proportion of both the rise in employment and participation in November and thus the flat unemployment rate.

- For December we are expecting a more average sample to roll in which should result in both a lower employment to population ratio and participation rate. This should limit the rise in the unemployment rate to 5.5% despite the 10k dip in employment.