A report on BTC from investment giant Allianz is scathing on the cryptocurrency

The note is written by Allianz head of global economics and strategy Stefan Hofrichter, who says it ticks the checklist as an asset bubble:

- lack of regulation

- launch of new products

- rapid increase in trading volumes

- use for criminal activity

- and more

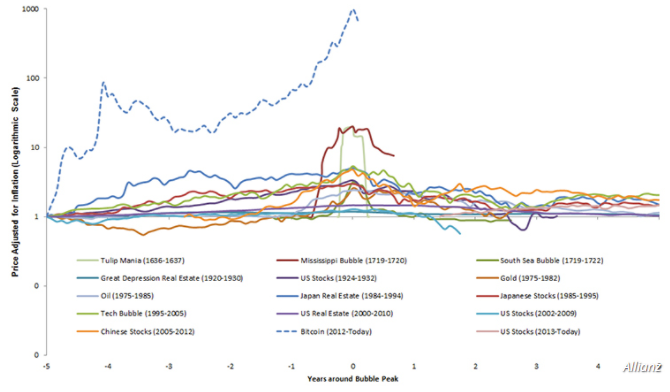

"The hyperbolic price movements of bitcoin since its early 2009 inception have been very bubblelike in nature,"

And, he makes unfavourable comparisons:

- "And among more recent examples, bitcoin far surpasses the IT bubble of the 1990s and the Japan bubble of the 1980s."

As for valuation, he is no more complimentary:

- "In our view, its intrinsic value must be zero: a bitcoin is a claim on nobody-in contrast to, for instance, sovereign bonds, equities or paper money-and it does not generate any income stream"

Just in case you are in any doubt what Hofrichter really thinks, there is even more at the article, via MarketWatch

;-)

--

ps. My earlier post on BTC, some better news for it: