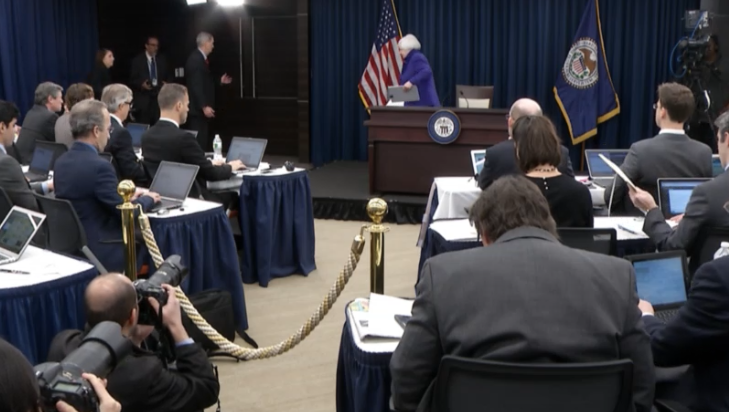

Yellen continues to take questions from reporters:

- I don't see anything to suggest a negative outcome for the US

- We want to eventually operate with a much smaller balance sheet

- Fed studying long-run framework for balance sheet

On high yield:

- Spreads in high yield have been widening since 2014, partly due to oil

- Third Avenue was an unusual fund

On hike:

- We are starting early and gradually because we don't want to cause a recession

- We have considered the risk of moving too early

- Abrupt tightening is the usual reason central banks cause recessions

- This decision reflects our confidence in the US economy

- Longer term rates unlikely to move very much

On persistent 'transitory' inflation

- If we conclude structural factors are holding down inflation, we would take action

- We would need to see a sustained departure from 2% inflation goal

- Fed looks at range of inflation statistics

On the upside economic risks:

- US consumers are in healthier conditions

- Demographics point to considerable upside in housing and residential investment

- Recent growth in emerging markets have strengthened

On path of rates:

- Strongly doubt there will be evenly spaced rate hikes

- We will be data dependent

- Main reason we lowered our PCE forecast was stronger dollar

- I don't see interpretation of inflation and models as having fundamentally changed

- All forecasting models are "not perfect"

Wages:

- We may be seeing some insipient signs of wage growth

- I hate to say it's a firm trend, we've been disappointed in the past

So far, there have been no strong headlines in the press conference. Yellen is a master of speaking endlessly without saying anything meaningful.

Ok, that's all she wrote from the Fed for 2015.