The non-farm payrolls preview for April 3, 2015 that sticks to the numbers:

Release time is Friday at 8:30 am ET (1330 GMT):

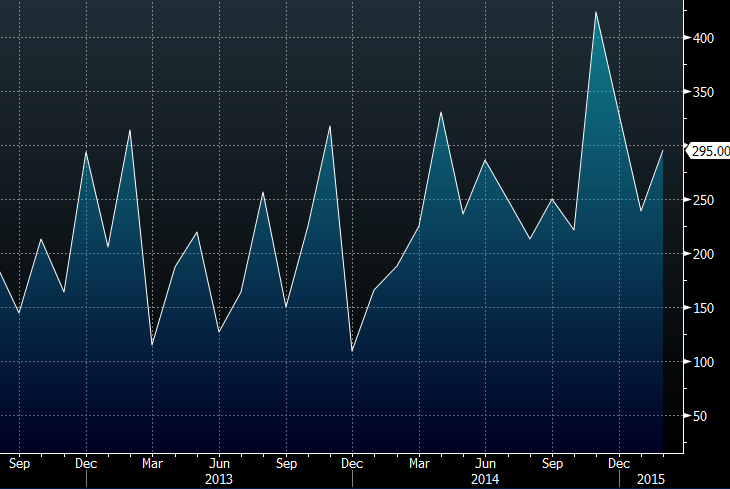

Nonfarm payrolls steadily improving

The market has soured a bit on the US economy over the past month. Q1 growth estimates have been revised down dramatically with many firms now looking for something around 1% compared to 2.2% at the start of the year. That's left traders with a bad taste in their mouths heading into the data.

The US dollar rally has sputtered in the past few weeks, especially against the euro, but it would only take one good number to turn it around. The market had begun to look away from jobs and toward inflation data but Fed Chair Yellen warned against that last Friday, saying she still considers jobs to be the key indicator. Lockhart underscored that approach on Wednesday.

What makes this report especially intriguing is that it falls on Good Friday. Many markets are closed so the data will be landing in an illiquid market. In many ways that argues for staying out of the way.

Once the dust settles, I believe the strong US dollar trend will remain and if the data is strong and the market doesn't move to quickly, that's a buying opportunity. If the data is weak, traders might want to wait for a washout on Monday/Tuesday before looking to buy the dollar at better levels.

For more on non-farm payrolls and a technical setup to watch, check out the infographic prepared by Greg Michalowski.