The quid gets a shove up from Yellen but it need to hold itself up or it will undo all the good work

The old girl went and done it again.

Yellen managed to kick the dollar in the knackers once again and the pound has been one of many to make the most of it.

As with any moves that come after a talking head, the impetus needs to be maintained or all that hard work tends to go out the window. One of the levels on the way up has become an important one on the way back down.

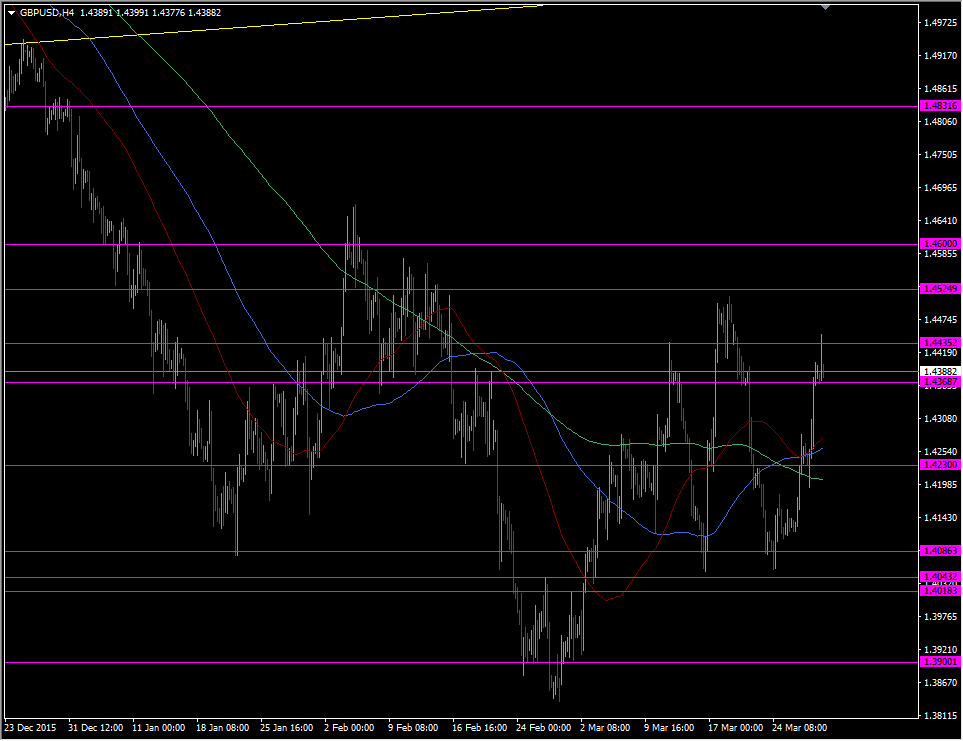

GBPUSD H4 chart

1.4365/70 is one of those funny levels that a currency can ignore when something interesting is going on, then takes notice of when things are quieter.

On the way up, we first stopped around 1.4375, then made the area support through Asia, and now it's support again after falling from the high. As I type 1.4380 is becoming the support just ahead of this point.

The risk to this rally is that we break this line. In doing so it could mean a pretty swift drop back down to the pre-Yellen levels around 1.4260/1.4300. That will wash out all the good work and might even bring a greater loss as more longs throw in the towel on this failure to stay up.

Should the rally keeps its momentum, we have some minor resistance points around 1.4465/70 & 1.4485/90 but the bigger prize will be 1.4500/15. In the first instance cable needs to get back above 1.4400, and it's showing signs of struggling to do that.

For now, 1.4400 and 1.4365 look to be the decision making levels in play so trade them accordingly.