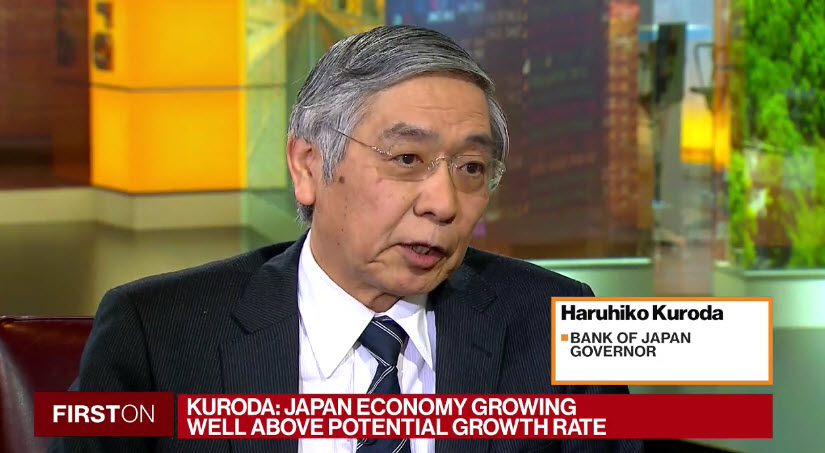

Unscheduled comments from the BOJ

- Doesn't see any constraints to BOJ policy

- BOJ has 40% of JGBs, that means 60% are in the market

- FX rate can affect inflation in the short term

- We see a gradually rising inflation rate

- When the yen rises due to global geopolitical risks, it complicates policy

- Our inflation forecast is based on continued improvement in jobs and closing of the output gap

- We're confident we can meet our inflation target in mid-2018 but that assumes stable yen

- We will stick to yield-curve control, that means JGB purchases could rise or fall depending on market conditions

- Real economy is better than we anticipated a few month ago but inflation still sluggish

The comments are from an unterview on Bloomberg TV that's on now.

The initial comments have sent USD/JPY back near the highs of the day.

Key line:

"We stick to yield curve control. Under yield-curve control, purchases may decline or increase but we think the current pace of purchases and monetary base increase will continue for some time."