With the possibility of a being hit by a lot of information at once here's 3 simple things to look out for if trading the MPC and inflation report

Mike has done a great job on the main preview so I'm going to try and keep it simple for trading by looking at 3 main points that will move the pound

1. The votes

This will be the big news initially for the pound. Any increase in the votes for hikes will see the quid spike. Another 1 vote to make 2-7 for hikes and we'll get a moderate pop. 3 or more and we're likely to get 100+ pips. Staying 1-8 will bring initial disappointment but that might be quickly tempered (or aided) by the text of the statement/minutes

2. Economic growth

Q3 growth was softer. Q4 has started brightly. "Headwinds" will likely be the main theme on the dovish side. The October data while better, comes on the back of a downtrend so the BOE will need to see it sustained. The employment data will be very big in their views of the economy and it was very positive

3. Inflation

Carney & Co have got more chance of changing the tide of the Thames with interest rates than changing the tide of inflation, particularly with oil/energy prices. Any hawkish remarks here will again come on employment and the uptrend in wage gains. While the extended period of low oil prices will filter through into core items as the months roll on, strong wages gains will make it easier for the UK population to weather rate hikes, even with lower expected core prices. A lot of focus will be on whether the forecasts change to show higher inflation further out but the real trade will be on the reasons. If they're domestic reasons then that's a green light for the pound

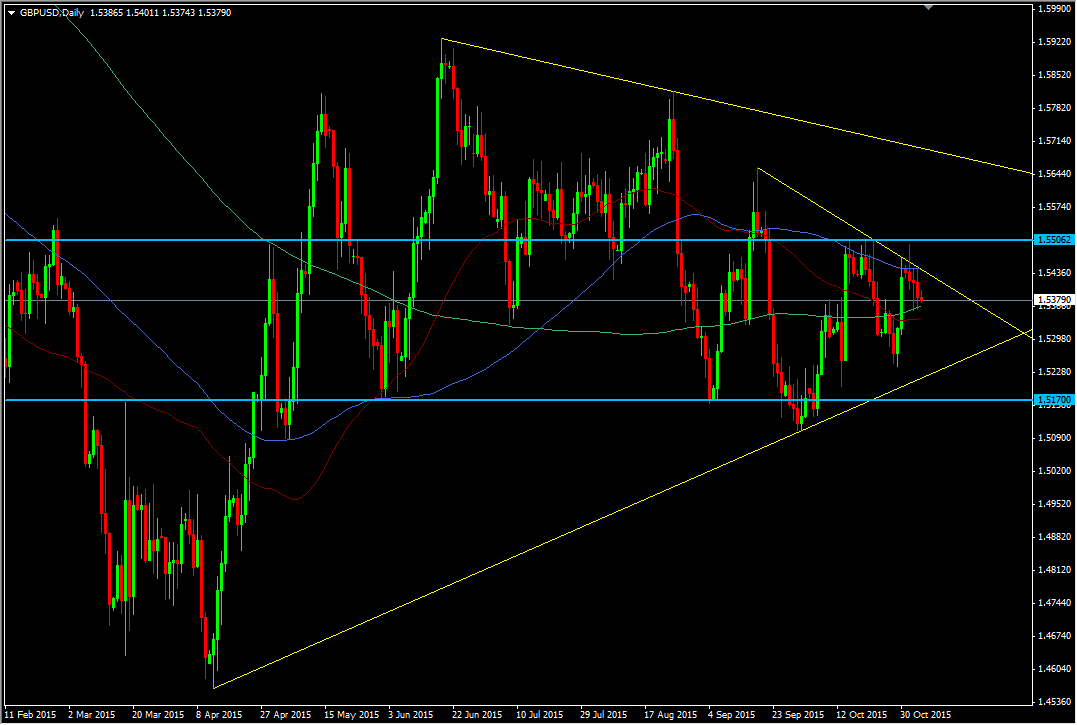

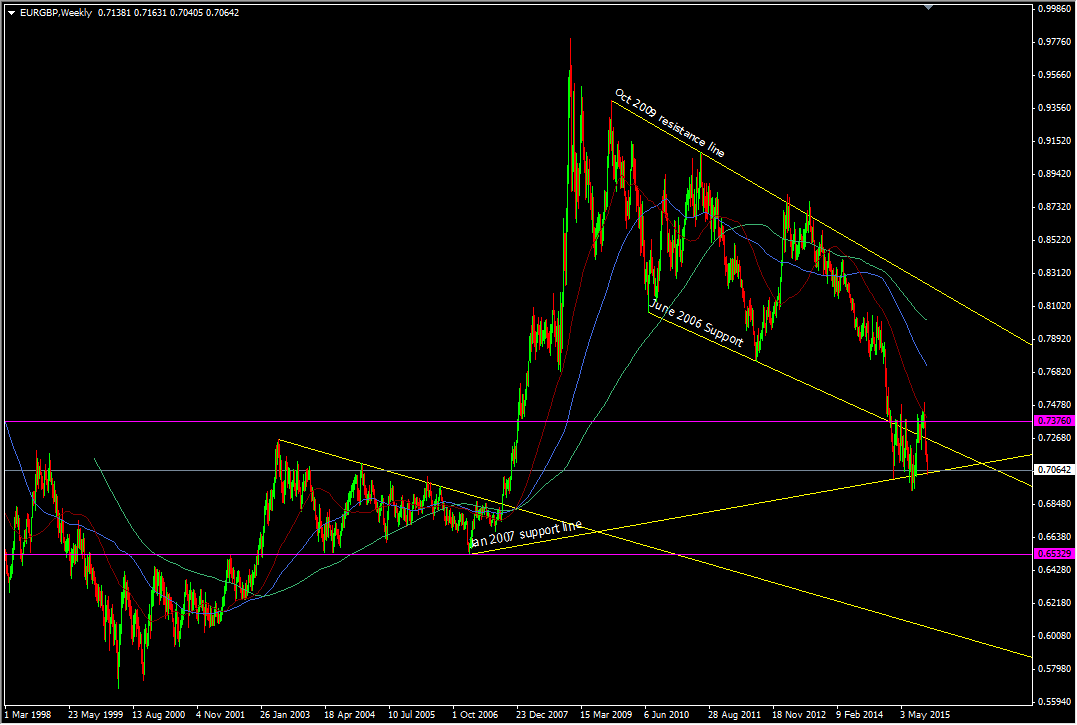

A quick look at the charts shows us the boundaries to watch

GBPUSD daily chart

EURGBP weekly chart

My overall view is that if we get a hawkish BOE then there's going to be a lot of scrambling to bring forward hike expectations, and seeing how far out most of them are, that could mean some big upside for the pound. Dovish and that might change the sentiment to a softer quid here on out