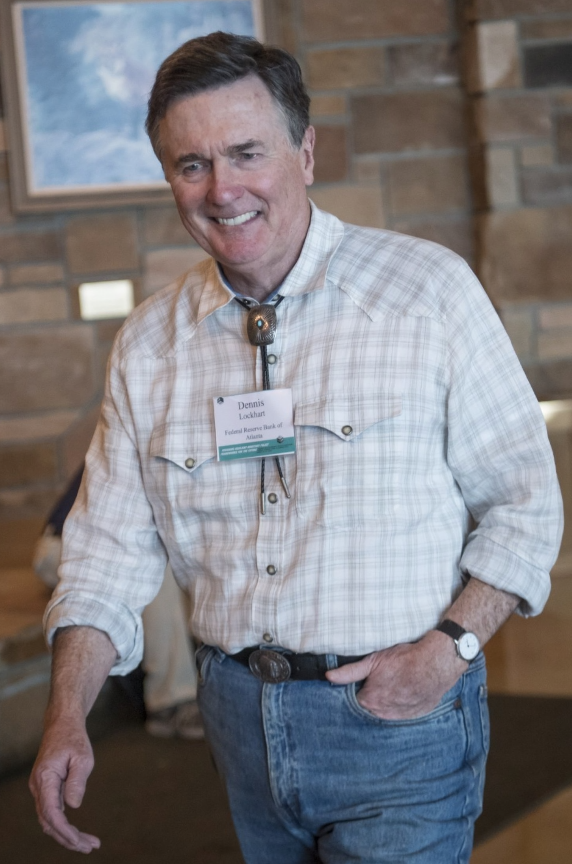

The Fed's Lockhart on the September

From the transcript from his interview with the Washington Post:

"The best way to explain my position on September is to explain what my position is on the economy. And that is that the second-quarter GDP number can cause overreaction. The low number suggests an economy that has slowed down pretty markedly in the last three to four quarters from what was already considered a very slow pace of growth.

But if you look through the headline GDP number to real final sales - which is GDP less inventory - what you see is that the economy is actually performing better than the headline number pretty consistently over the last few quarters. Much of the disappointment has been the result of inventory swings.

You have to explain why we've had a drag from inventories, and that's an important question. But I think the economy is chugging along at a moderate pace. If the incoming data between now and the meeting in September don't push me off that view, then my position is we should at least have a serious discussion of policy action at the September meeting. I'm not calling at this stage for a rate hike. I'm not even sure I will support it. But I'm calling for a discussion if what we see now persists until mid-September."

How do you price in "at least a serious discussion"? The Fed funds market is priced at 36% for the Sept 21 meeting.