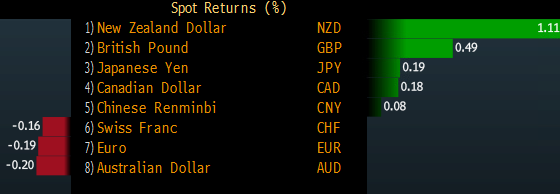

The New Zealand dollar is soaring

The rally in the New Zealand dollar today is all about what the central bank is saying and what housing regulators may be planning to do.

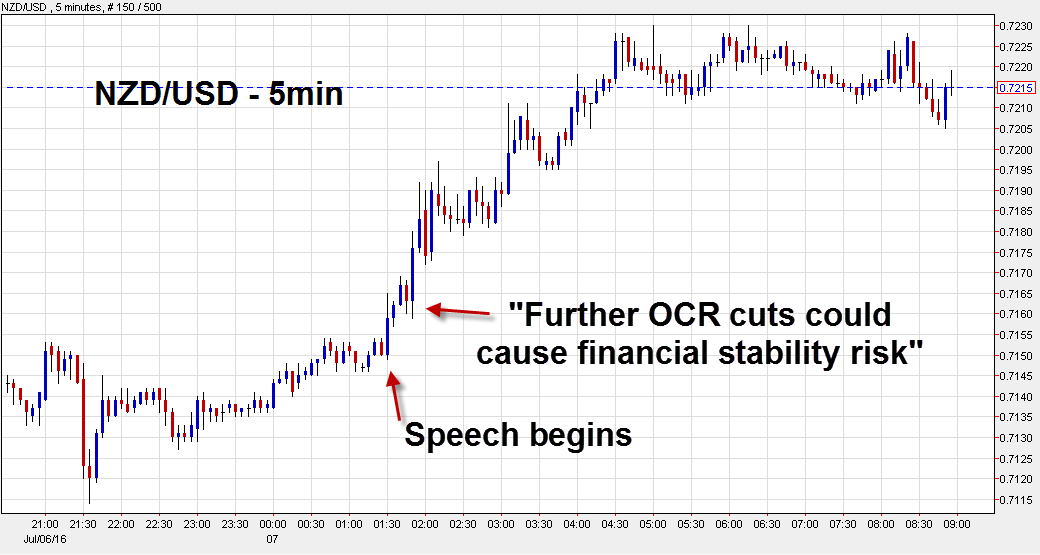

The key headline came from Grant Spencer, who is the Reserve Bank of New Zealand's second-in-charge who warned "further reductions in the OCR could pose a risk to financial stability." The OCR is New Zealand's policy rate.

Before the comment, the OIS market was showing about a 65% chance of a cut in August, rising to 80% by year end.

In the aftermath, NZD/USD rallied 85 pips.

The early part of the rally might have been due to the slow uptake from the market. The RBNZ has forsaken lockups and it took 21 minutes after the speech was released before a newswire picked up the key headline.

What the RBNZ plans to do

Based on that headline alone, the NZD/USD rally is justified but the flipside is that the RBNZ and the government appear to be planning fresh measures to cool housing.

"The Reserve Bank is considering tightening Loan-to-Value Ratios (LVRs) further to counter the growing influence of investor demand in Auckland and other regions, and to further bolster bank balance sheets against fallout from a housing market downturn. Such a measure could potentially be introduced by the end of the year," he said in the speech.

At the moment, investors must make at least a 30% downpayment on a home in Auckland. He said that could be raised and introduced nationwide.

He also said the central bank would investigate limiting debt-to-income ratios and a housing capital overlay.

The market got it right, for now

Reading the speech, the tone is hawkish and the RBNZ clearly wants to deflate the housing bubble. It's clear, however, that they won't be doing it with interest rates.

He said the RBNZ framework "rules out actively leaning against the housing cycle using monetary policy."

Yet he took careful care to shift the debate, opening the door to ignoring inflation.

"While the outlook for CPI inflation will ultimately determine the future path of monetary policy, the trade-off against financial stability risk needs to be carefully considered," he said.

Given that he put the timeline of introducing the new measures as year-end; to me that rules out a near-term rate cut and will likely keep the RBNZ on the sidelines through year end.

However, the playbook from the RBNZ in the past was clear. They aim to use macroprudential tools to target housing specifically while simultaneously using monetary policy to stimulate the broader economy.

To me it's clear that the RBNZ wants to cut rates but feels it can't until action is taken on housing. After the new policies are implemented, look for a rate and New Zealand dollar weakness but in the meantime, the path for the kiwi is higher.

Technically, wait for a break of Monday's high and target a rally from there.