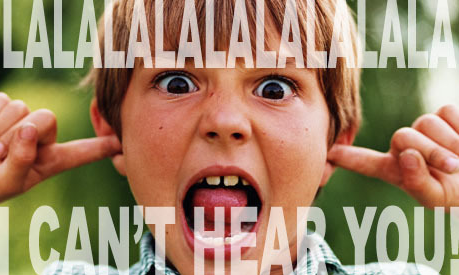

The problem with predictions and ego

Pickup and economists research note from the past month and it's likely to say the same thing -- the Fed is going to hike in June.

Everyone is singing from the same hymnbook. The problem is that the Fed is the piano player and yesterday changed its tune. This is the line in the FOMC Minutes:

"Members generally judged that it would be prudent to await additional evidence indicating that the recent slowing in the pace of economic activity had been transitory before taking another step in removing accommodation."

That can't be misunderstood.

What it says is that if economic data continues to be soft, they're not hiking in June.

That doesn't mean that a hike is off the table but it certainly means that it's not a sure thing.

Here are a few data points since the May 3 meeting:

- Q1 nonfarm productivity -0.6% vs -0.1% exp

- Factory orders +0.2% vs +0.4% exp

- Nonfarm payrolls 211K vs 190K exp

- Avg hourly earnings 2.5% vs 2.7% y/y exp

- JOLTS 5743K vs 5725K exp

- Core PPI +0.7% vs +0.2% exp

- CPI +2.2% y/y vs +2.3% exp

- Retail sales control group +0.2% vs +0.4%

- Empire Fed -1.0 vs +7.5 exp

- NAHB housing market index 70 vs 68 exp

- Housing starts 1172K vs 1260K exp

- Building permits 1229K vs 1270K exp

- Industrial production +1.0% vs +0.4%

There is some positive news sprinkled in there but nothing that would inspire confidence. Add in today's soft trade and inventory data as well.

There are still many indicators to come before the June 14 FOMC decision but the 83% chance of a hike that's priced into Fed fund futures is too high.

But economists have too much ego and credibility invested in June hikes to change their calls yet. They will hang on as long as they can. But if economic data continues to disappoint, look for a Fed official to send a signal and then the economists will rush to change their calls. At the moment, just 12 of 78 economists in the Bloomberg survey are calling for no move.