Would a solution on Greece lead to big gains in EUR/USD?

A good question from Reja in the comments on what would the impact be to the euro if Greece strikes a deal

It's probably sensible to break it down into two simple parts

A can kick deal

Any deal that shifts the focus down the road will probably only see a marginal move up in the euro. The price action we saw when Greece announced it found enough cash to get it through April and May was enough to see us test 1.0800. The reaction after gives us some idea how piecemeal solutions last in the price. I would expect a similar reaction to a temporary deal

A full on, problem solving deal

Something like a debt restructuring deal alongside Greece playing ball on reforms asked of it would give us the biggest bang for our buck. Unfortunately the devil in the detail will be very important but any headlines that flash "Greece reaches a deal" will see the euro pop. The question will be whether it will bring us out of the current range or will it be faded after some short covering for a big gain in pips?

As with all surprise events you have to judge it alongside what is happening in the market at the time. We know the euro is very susceptible to the dollar right now and the ECB is still pumping. At the moment dollar buyers are still happy to grab those dollar dips and that's likely to make any upside moves much harder. At the moment my gut feeling from watching the PA in EUR/USD is that it wants to have a pop higher and is waiting for a good reason. Greece might be it.

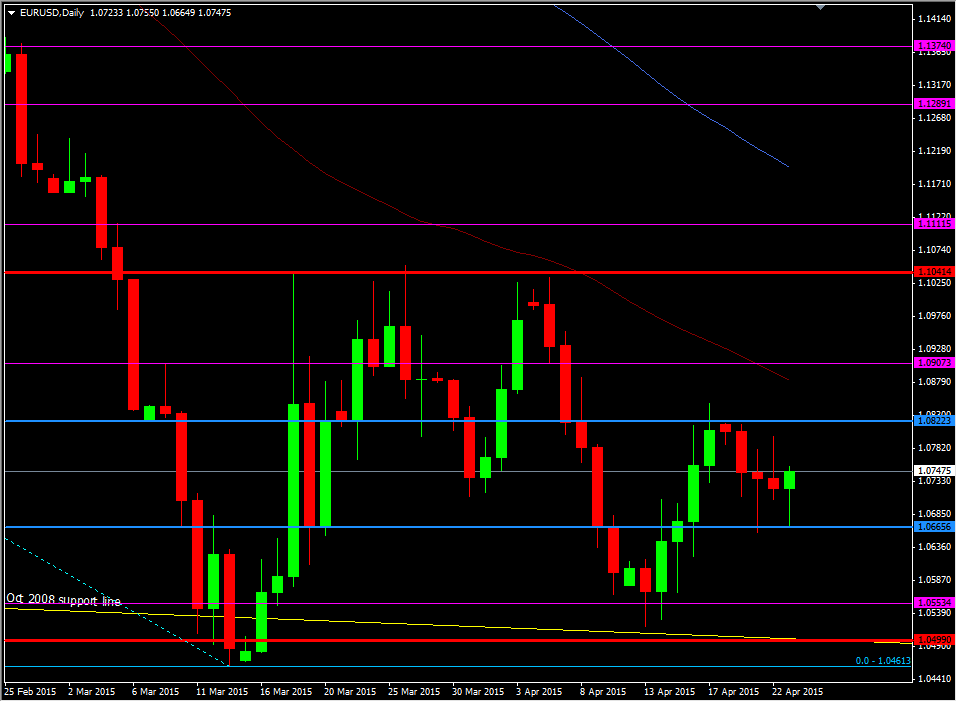

We're ranging between 1.0660/65 and 1.0800/20 (blue lines) and further out 1.0500/20 and 1.1040/50 (Red lines mark the wider edges

EURUSD daily

Ultimately it will take a proper break of the levels on the red lines to confirm a proper move. The upside boundary is wide enough to look at taking a speculative short that any pop to there won't last, and the trade can be kept fairly tight. Should we confirm the break with a hold of the subsequent retest of the 1.1040/50 level then that will be the cue to exit or switch to longs

Of course we could get no deal and a default but that news may not happen until closer to the June deadline, and there's plenty that can happen between now and then. For all the bluster Europe and Greece have continually managed to cobble something together just when the situation looked bleak. I see no reason why they won't this time. Look through the politicising element and think about whether an exit is really on the cards or the best solution for both parties

For getting onboard now, I would say the chances are we will get a deal or positive news of sorts in the next couple of weeks so it may be worth buying dips sub 1.0700. A hawkish FOMC next week may give us a look towards the lower boundary and a chance to load some longs for a Greek deal

As always, analyse the news in the context of the market at the time but for this event it looks pretty straight forward based on where we are right now

Greece - Deal or no Deal?