Why is it always so hard to find out what time the Bank of Japan decision is?

That's because there is no set time for the monetary policy decision from the Bank of Japan. BOJ Governors meet and discuss and then release their decision when they're ready.

In theory the decision could come out any time but in practice, the announcement is almost always made around 0230 GMT to 0330 GMT.

The rule of thumb is that the longer the meeting takes, the more likely the Bank of Japan is to introduce some new-fangled type of monetary easing. The Japanese are good at many things but nothing better than designing video games and finding creative ways to expand the BOJ balance sheet.

What's expected from the BOJ today?

Not much. Bloomberg polled 42 economists and only one of them is anticipating more easing. The metric is the BOJ's annual rise in the monetary base. It's currently ticking over at ¥80 trillion per year.

Earlier this year a whole bunch of economists were expecting something in Q3/Q4. At the October meeting 16 of 36 economists forecast more easing despite repeated comments from the BOJ that they were confident in inflation getting back to 2%. That's when they finally got the message and the BOJ has been virtually-explicit that nothing is coming today.

It's more a question of when the BOJ will ease more.

So it's all about the communication

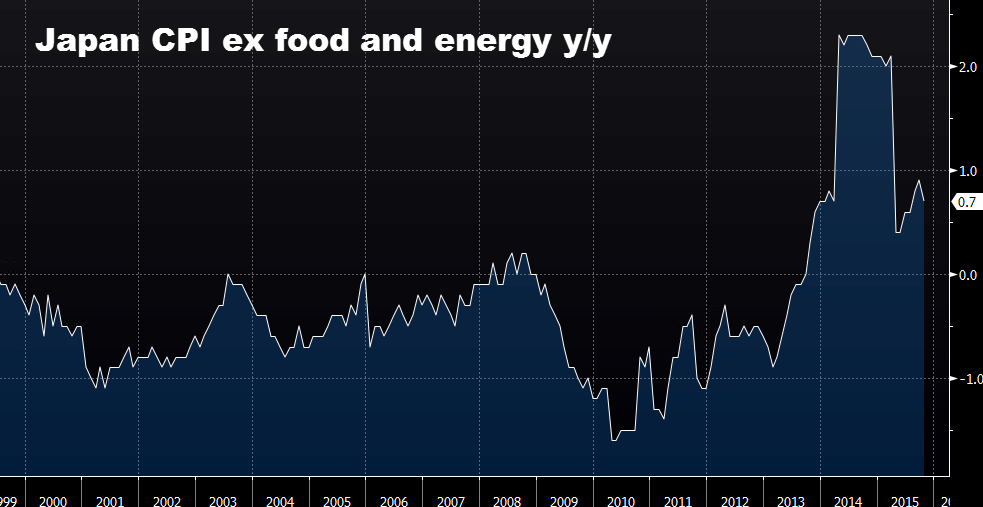

The BOJ is big on rhetoric surrounding the target timeline for returning to 2% inflation. Of course, it's all just fantasy. The only time Japan has had anywhere near 2% inflation this Millenium was after last year's consumption tax hike.

Not even a 50% decline in the yen has brought inflation.

So the whole world plays along with the charade that inflation is just a few more months from returning to 2% inflation but they might have to ease more if the target is in jeopardy.

The current forecast is for the second half of fiscal 2016 -- that's between Oct 2016 and March 2017. New forecasts are due in January.

Signals to watch for

Watch the statement and for comments from Kuroda at his 0630 GMT press conference.

The BOJ has been increasingly upbeat about the economic outlook after this year's recession was revised away but a change to the Q3 estimate. The numbers have generally been good, at least until yesterday's November trade report showed weaker-than-expected imports and exports. The Tankan numbers this week were good but the outlook was soft.

Inflation expectations are also on the mind of the BOJ. Press leaks suggest they're concerned about falling oil prices and their effects on public perceptions of prices.

"Inflation expectations appear to be rising on the whole from a somewhat longer-term perspective, although some indicators have recently shown relatively weak developments," the November statement said.

They've also been polling companies about wage hikes.

The vote is also interesting. It was 8-1 in November with Kiuchi dissenting because he's tired of all the easing and wants to scale it back to ¥45 trillion/year.

It's the second best time of year for a surprise

Bank of Japan Governor Kuroda is said to like surprises. He thinks central banks are more powerful when they shock markets. He had the surprise of the year in 2014 when he expanded easing on Halloween and sent the yen into an epic tailspin.

How about a Christmas surprise? I doubt it.

What's the BOJ trade?

The idea that the BOJ will back away from more easing next year is growing on me. There is quite a bit of easing priced in and the yen could rally hard if the story changes. They've doubled down on QE seven times and keep coming up empty and the cheap yen isn't helping trade. Maybe time for a new approach?

More on the BOJ:

- Nikkei: "Lower inflation expectations cast shadow over BOJ's 2% target"

- Bank of Japan is polling firms nationwide on their plans to raise wages

Interested in trade ideas from ForexLive. Get our top-10 trade ideas for 2016.