It looks like the dollar is in need of some 'healthcare' to patch it up

The US dollar is the sick man of FX today as traders get a first real chance to batter the currency after the healthcare howler from the US.

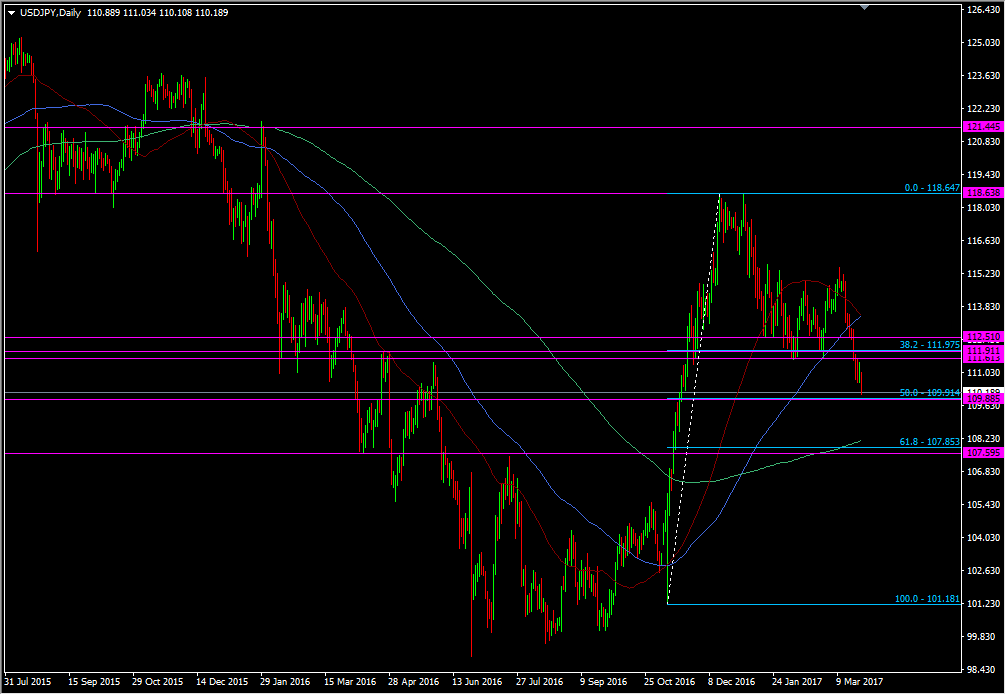

As expected, once the bad news was confirmed, USDJPY was slapped down to the low 110's. The failure to get itself above last week's broken support levels was a strong indication that any rallies above 111.00 were on shaky ground.

USDJPY daily

The 110.00 level is a very significant level. We have the 50.0 fib of the Nov rally at 109.90, and the 109.80/90 area was a level of S&R back in April last year.

It's also a big psychological level and one that if broken, will have traders looking at the next one down at the big 100.

There's a few stand out levels under 110. The 108.50/60 level is one, then the 200 dma at 108.13, which sits not far from the 61.8 fib at 107.85. The 107.50/60 area is another to keep in mind.

There's a long way to go to see those levels and we won't go there just on the healthcare Bill. What will take us there is if the market starts getting real jitters over Trump's ability to shape US policy, and we should get an idea of that over the next few sessions. Today's US open will be important so keep an eye on US yields (hovering near lows). USDJPY is already starting to edge back towards 110.00 as it trades as 110.17 from a weak bounce to 110.40. And that folks is the ballpark for the next few hours. 110.12/00/109.90 to 110.40 is going to be where the next direction is decided.