Morning note from Westpac on the Australian dollar

Sean Callow notes (bolding mine):

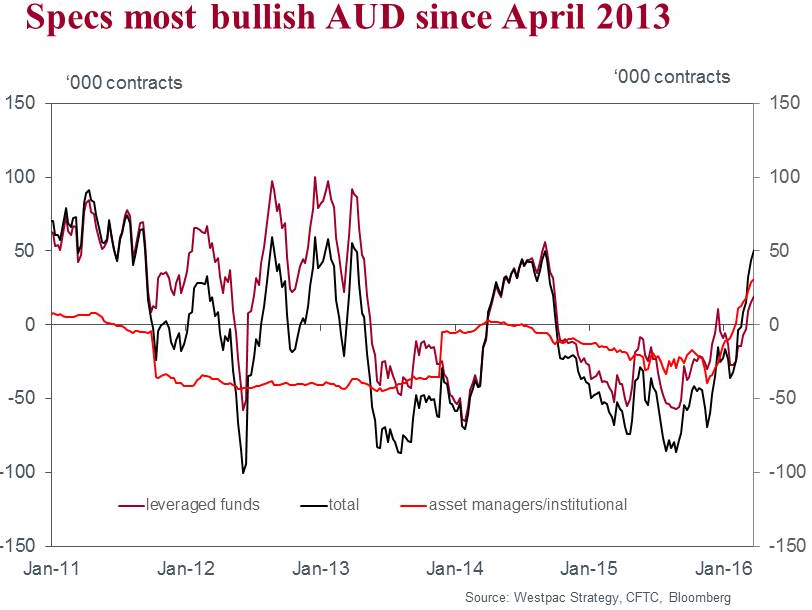

- Friday's Commitment of Traders report revealed another week of increased AUD bullishness among speculators in futures markets

- Leveraged funds extended net longs from 15.4k contracts to 19.5k

- While asset managers moved from 28.7k to 31k

- The combined total of 50k is the most upbeat AUD stance since a near-identical stance in Sep 2014 and before that, April 2013

-

Callow notes on other currencies:

- Leveraged funds trimmed EUR net shorts slightly, to -69k and were about steady on JPY, long 45k. The Brussels attacks look to have driven renewed sterling shorts linked to EU exit risks, from -26k to -48k.