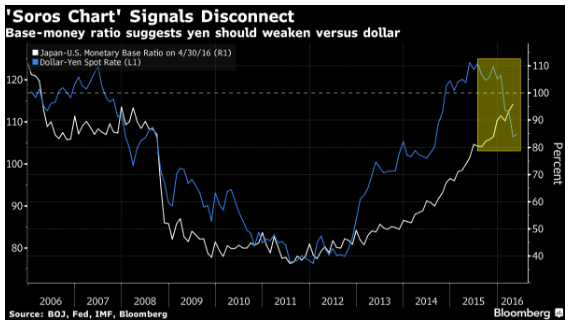

Over the weekend, Bloomberg reported on the famous 'Soros Chart' for USD/JPY

- BOJ bond buying has nearly trebled the monetary base in just over three years

- Base money in dollar terms is at its highest relative to the U.S. since 2006 at 96 percent, despite Japan's economy being about a quarter the size.

- Some traders have dubbed the ratio a "Soros Chart," after billionaire investor George Soros correctly predicted in the 1990s that burgeoning supplies of funds would weaken the yen.

"An expanding monetary base is a factor for yen weakness, making it hard to imagine that the one-way strength that we've seen in the yen will continue," said Fumio Nakakubo, chief investment officer for Japan at UBS Group AG's wealth management unit. "There is an excess of yen in the market -- like how juice gets diluted by adding too much water -- and it will cause the yen's value to drop further and further."

-

Yeah, OK. this is an interesting piece but its not as if its new news. The BOJ have been quite explicit in their desire to substantially expand the monetary base. They haven't linked doing so to yen weakness because it wouldn't be politic to do so. But a nod is as good as a wink.