USDJPY is starting the day on the right foot but it's got a long way to go to undo the awful week it's just had

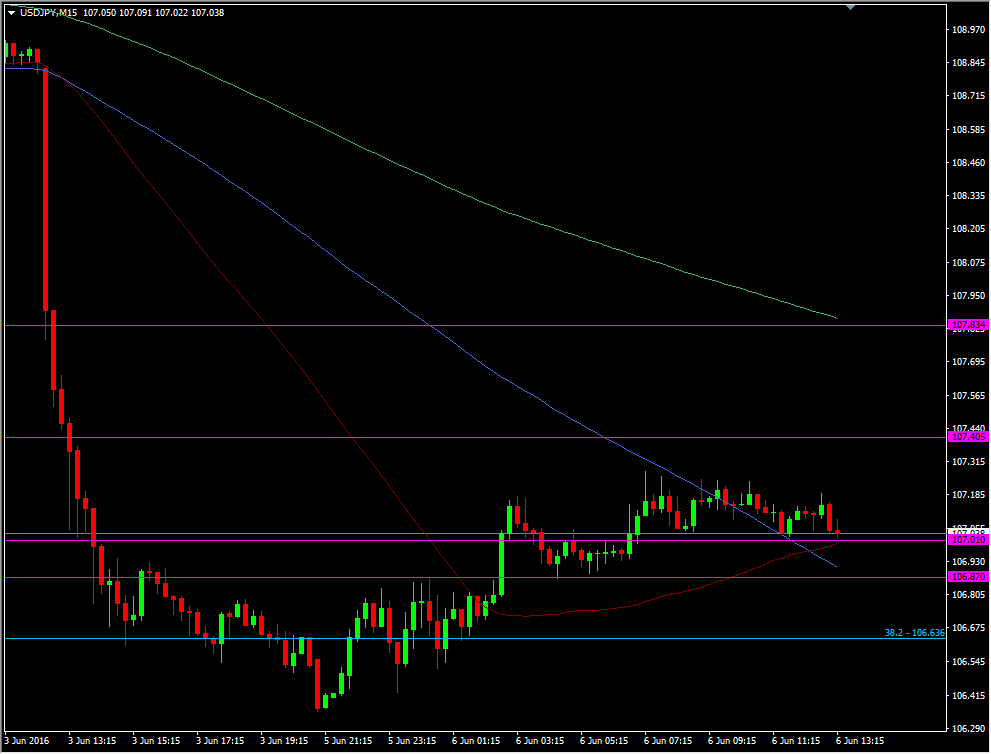

USDJPY is doing its best to stay above 107.00 as we head towards Yellen. The area around 106.85 was a minor S&R level in early May and it's proving thus again.

USDJPY 15m chart

107.40/50 was a decent resistance area during the same early May period and is likely to be so again, barring any major news from Yellen or elsewhere. 107.80/85 is where I'm expecting the protection of 108.00 to start.

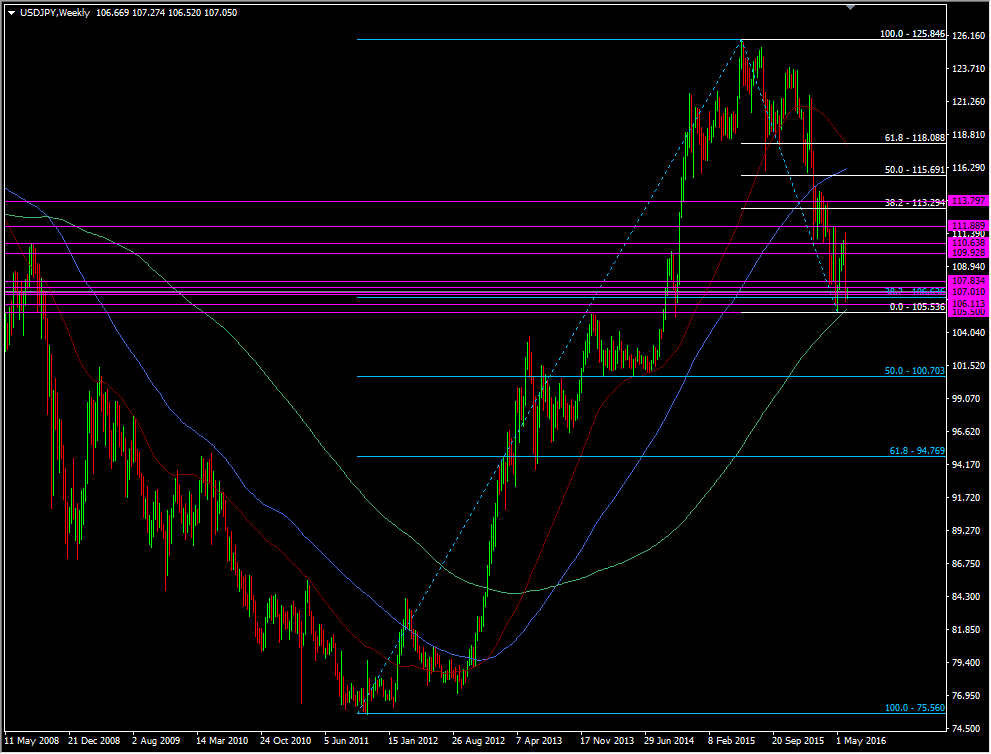

What has the NFP report done to the overall direction of the pair?

It's kept the down move this year, and from the 125.85 highs, intact. It's made sellers more confident and allowed them to push the price down even further. One thing I look for in this pair is consolidation and we may just have our edges. Around 112.00 is the top and the 106.00 level could be the bottom if we fail to test and break it over the next few sessions. We're also likely to see a tighter range within that range and that could be between 106.80/107.00 and 110.60/65/111.00.

For the bigger picture, 100.70 is next major support point on the card if we breach the 105.50

USDJPY weekly chart

Unless the US economy starts shooting to the moon the upside is going to be very hard, and certainly levels up near 120.00 look a long long way away. Yellen may make some comments that gets the buck on firmer footing but the market was rattled by the jobs report and won't forget it quickly.