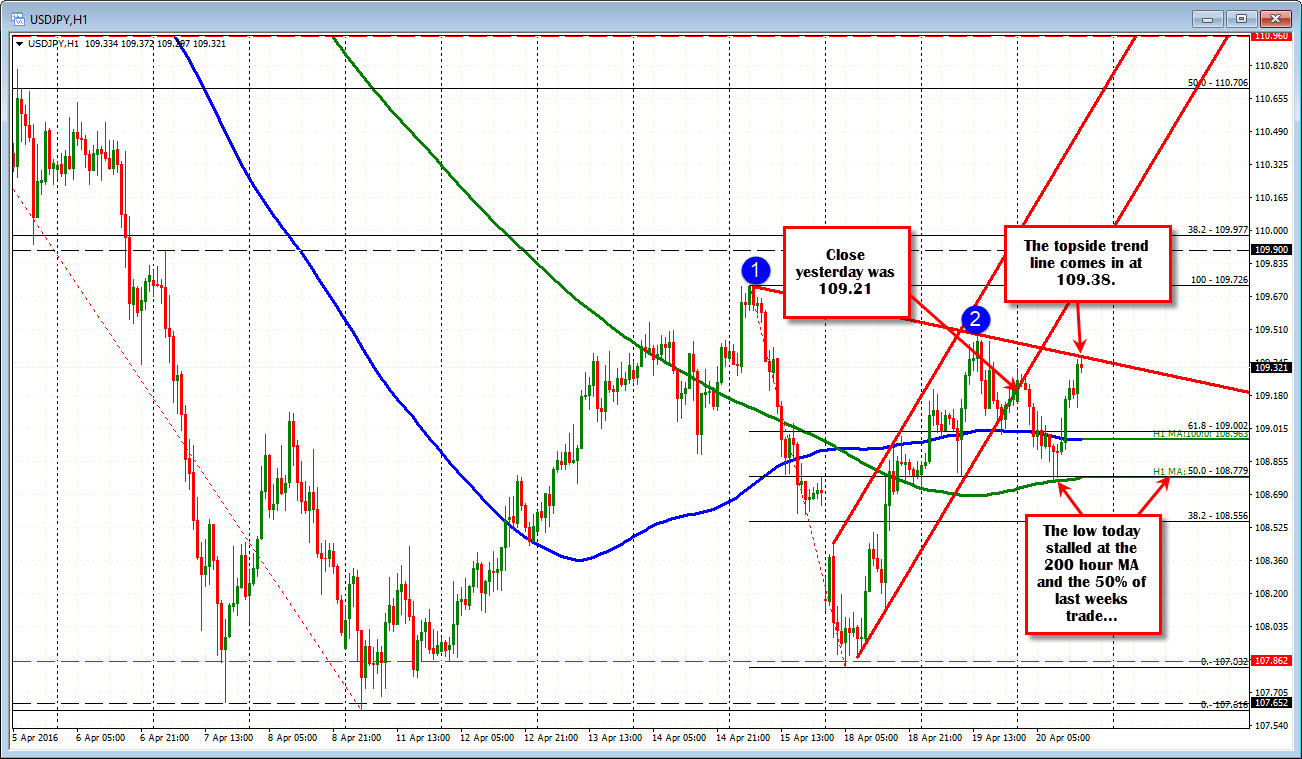

Tests topside trend line

The USDJPY fell in the Asia-Pacific session, bottomed in the early European session and has now reversed the loses and trading up on the day. On the way down, the price fell back below the 100 hour MA (well it trading above and below the line actually) but did find the buyers against the 200 hour MA (green line in the chart below).

So that dip and rebound shows buyers leaning against the MA level (PS it was the midpoint of the range from last week).

The bounce has now taken the price to topside trend line resistance which comes in at 109.38. Above the high from yesterday printed 109.48. The high last week extended to 109.726. Those levels become the next targets on a further extension higher. The range today is only 63 pips. The 22 day average is 96 pips. So there is room to roam on a break.

The close from yesterday comes in at 109.21. That might be eyed as close risk now. The 50% of the days range comes in at 109.065.

Buyers from that key support below are looking pretty good. The stock market is opening up little changed. Oil is lower on the back of Kuwaiti strike ending (trades around $40, down 2.39%). Existing home sales up at 10 AM with expectations of 5.28M annualized sales pace vs 5.08M last month. The commentary continues to whine about not enough supply.