USDJPY just can't pull itself away from the big psychological level

I'm getting very nervous about the current price action in USDJPY. We've been knocking around the year's lows now for quite some time and that's never a good sign. Yesterday I spoke to Tip TV about that very point.

So far jaunts below 100 haven't lasted long but the bounces have been very weak. It's doubtful that even a Fed hike would change the mood in this pair right now.

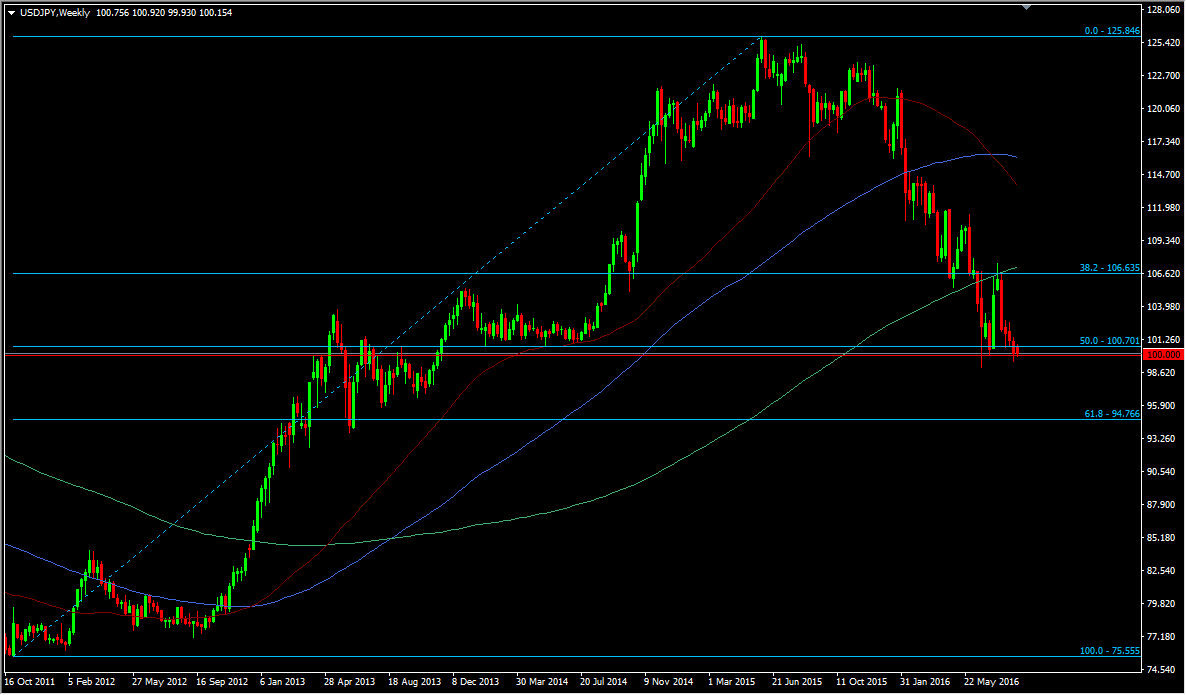

We're at a very important point here as we're between the 50.0 & 61.8 fibs of the big 2011 move. For me those levels are important for any trend as it is where traders are fighting over direction. The 61.8 fib is the line in the sand and where more will throw in the towel if it breaks.

USDJPY weekly chart

Because we are talking about the big move from 2011 this is huge for the fortunes of the yen and everything Japan has been trying to do with its economy.

The way the price action looks right now, we could well be building up to the type of blow through that the BOJ is on watch for, to get them hitting the intervention button. They won't if we casually drift down through 100 but if we start seeing one of those violent cascading moves, the intervention talk will ramp up.

Longs need to be very careful here and I'm certainly not looking to step in front of this potential bus. In reality, a proper clearance of 100 and 99 would confirm where we're going next and I'd be looking at trading a break with a tight-ish stop to protect against another break failure. I'd want to see confirmation of the price holding below 100 before thinking about adding to shorts or widening the stop.