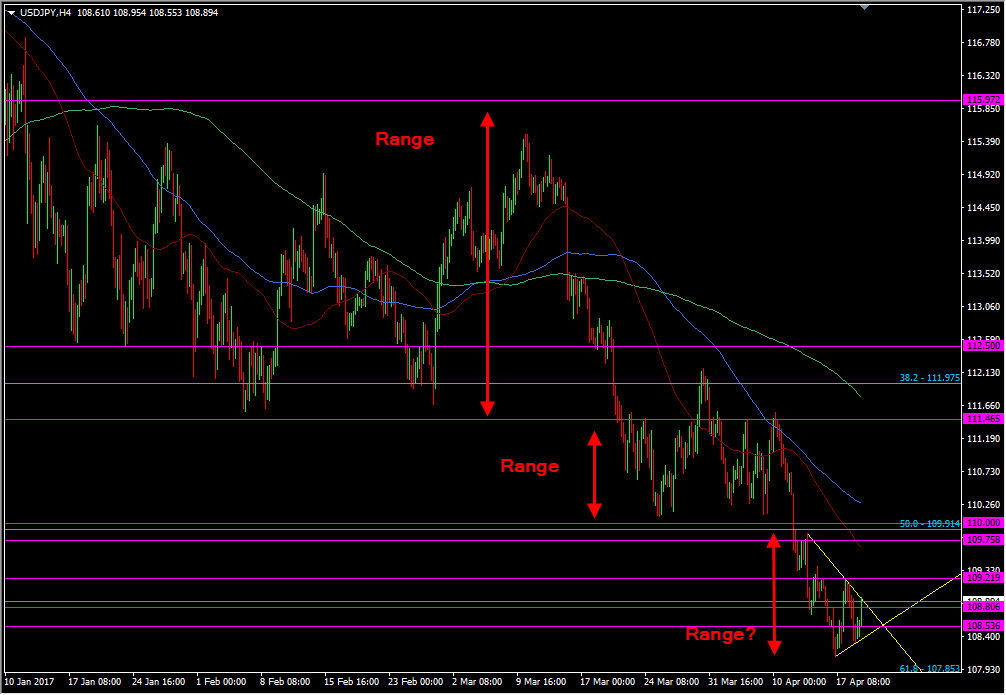

USDJPY looks to be trying to its next range

In many aspects USDJPY is a predictable pair. We often find it sits in a steady range for a prolonged period, has a break then finds another range to sit in.

The recent range was defined at 111.50/112.00 and 114.00/115.00/50, and the break in March then set a tighter 111.50-110.00 range. Too tight to be sustained, the next break brought us into the 110-108 area.

USDJPY H4 chart

Now we're waiting to see what range develops now, and while that happens there's will be plenty of opportunities to trade it.

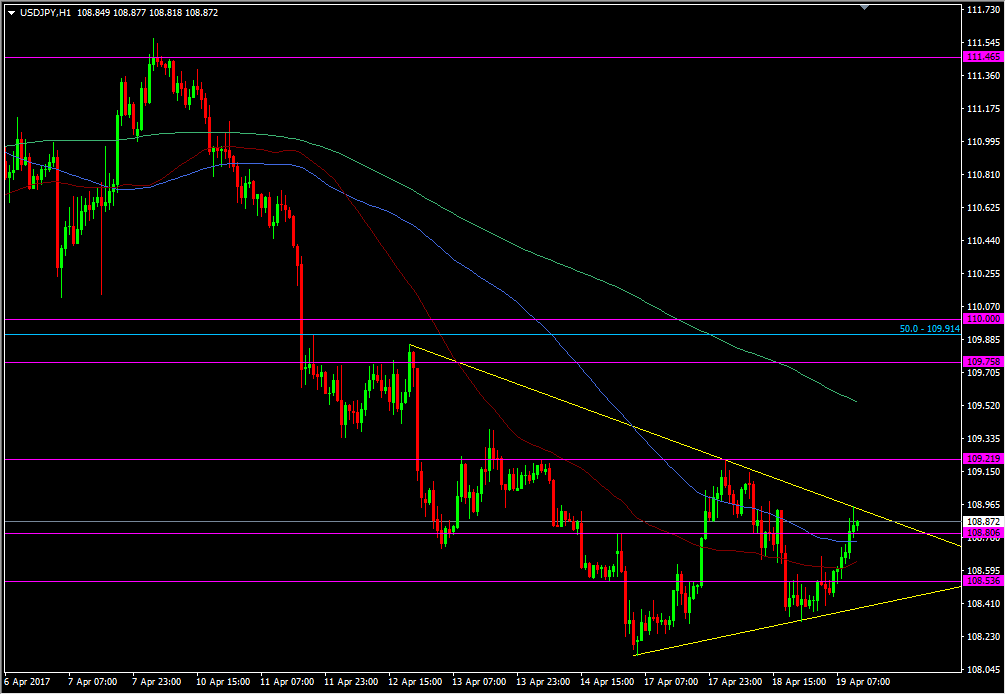

Right now we're in another tight range between the recent lows at 108.10/25 and highs at 109.20.

USDJPY H1 chart

When I look for a consolidation period in this pair my rule of thumb is something in the 300-400 pip range. Right now I see the top of the range building around the 109.75/80-110.00/10/20 area, and it's the lower end that needs to be defined further. Until we get that further definition, look at the top to lean shorts against (or take profit on longs), and vice versa against the low 108's.

If we do find ourselves sitting in a 200 odd pip range, that raises the risk of seeing additional, and possibly sustained, breakouts of those levels, or moves to define a wider consolidation area.

At the moment, I'd be more interested in shorting rallies than buying dips, purely because the upside is more defined than the downside.