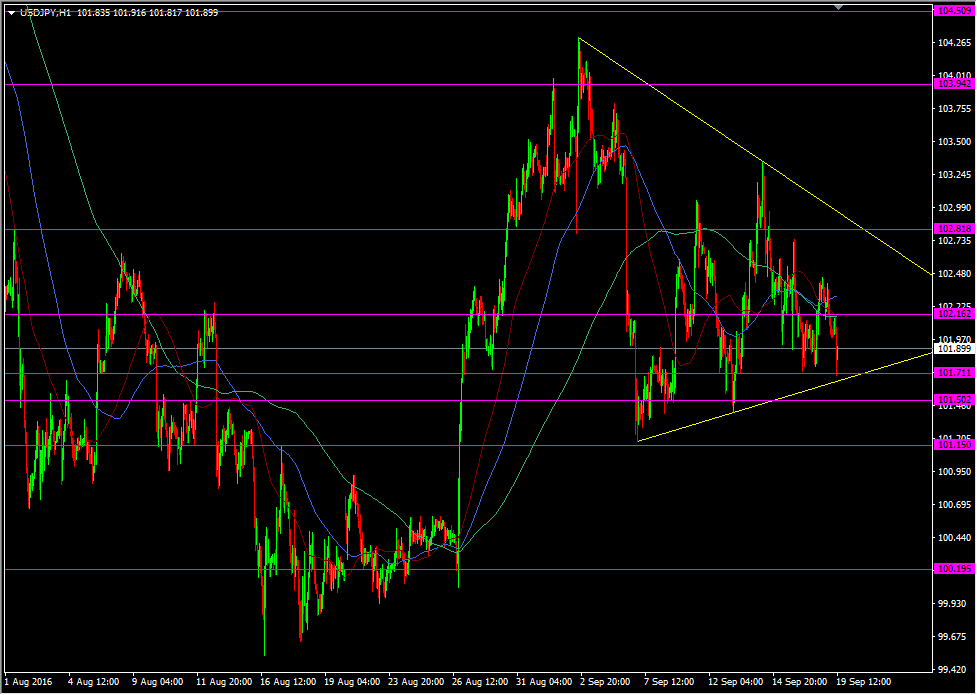

USDJPY climbs after hitting support at 101.70

Here we are in the big BOJ and Fed week (and RBNZ too). There's no data of note between now and the FOMC announcement, bar housing starts tomorrow. Today is a very dead duck with only the NAHB housing index at 14.00 GMT.

For all the volatility of late, USDJPY has set itself in a rough 200 pip range this month. Today we've tested one of those level within that range at 101.70.

USDJPY H1 chart

The bounce so far is pretty slow and we're edging towards 102.00. If we get through there then another prior S&R point at 102.15/20 awaits. It's been a minor level since late Friday and overnight but it held as resistance after the drop through from the high at 102.40.

I'm wouldn't think that there's a great deal of liquidity around right now. I would suspect that traders have pretty much set themselves for the central bank meetings and we'll only see minor adjustments made up until the BOJ announcement.

There's levels to watch and trade but it may be wise not to get overextended in any trades right now.