Can sellers keep the lid on it

The USDJPY price action since the move higher on the back of the Dudley comments earlier today, has been supportive...sort of. The "sort of" is because we do have higher highs on the 5-minute chart but sellers continue to show up near the 100.487 level.

What is the significance of the level?

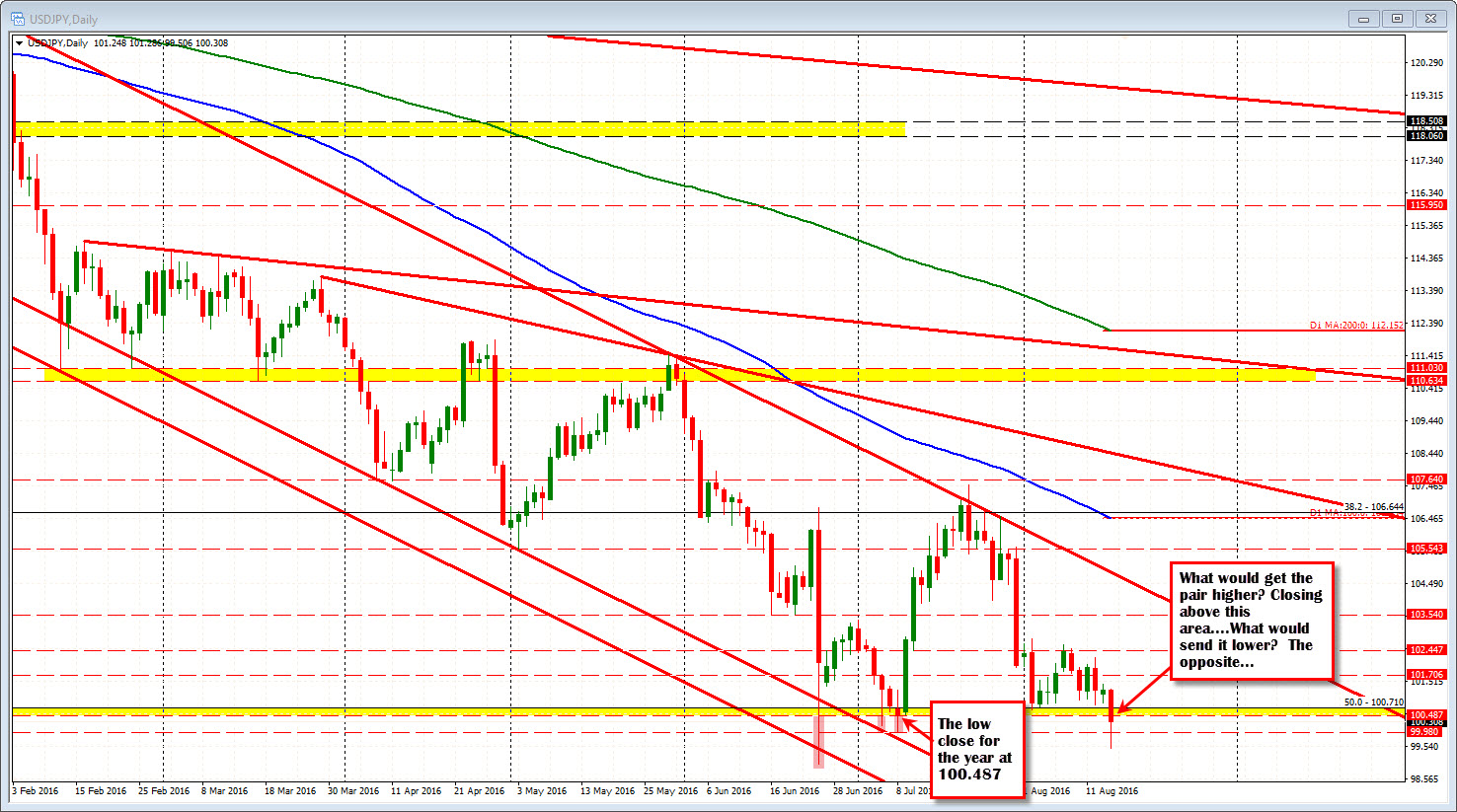

If you look at the daily chart of the USDJPY pair, there have been three prior looks below that level over the last couple of months. Two of those moves made it below the key 100.00 level. The third had a low of 100.18.

Today the price fell below the 100 for the 3rd time this year (it was only the 3rd look below parity since November 2013).

Anyway, the low close for the year has been 100.487. So if the price can close below that level that would be a new low close for the year. Traders like to hear that especially if they are short.

The high corrective price has reached 100.528. The last peak came in at 100.513. So traders have pushed the limit but are failing.

That is the story for the pair. The price is higher but so far, it looks like a new low close for the USDJPY. Still a long way to go to the end of the day. A move below 100.13 should solicit more selling.