When the predictions start reaching for distant numbers, it's often a sign of a top/bottom

Here is what BTMU had to say:

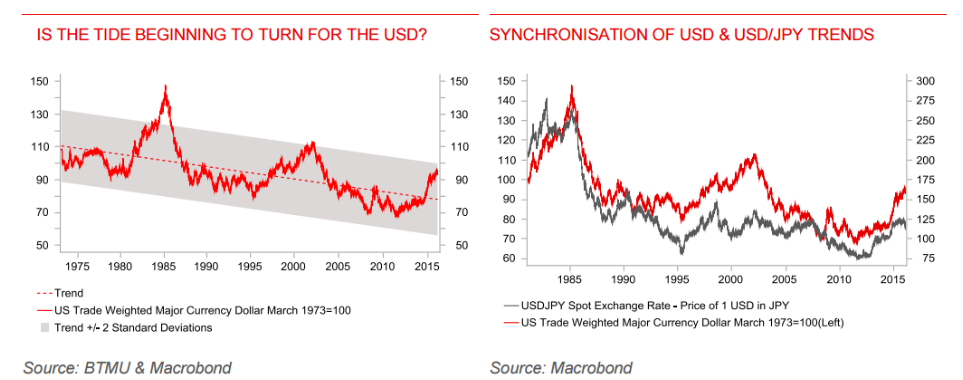

The recent broad-based weakening of the US dollar has added to the concerns that the bull-run is beginning to run out of steam, says Bank of Tokyo Mitsubishi UFJ (BTMU).

"The US dollar bull-run is already long in the tooth. It is almost five years since the US dollar bottomed early in 2011, and it has since strengthened significantly by just over a third according to the Fed's tradeweighted measure against other major currencies. As a result the US dollar is now almost two standard deviations above its long-term trend.

In comparison, the previous US dollar bull-run lasted almost seven years between early in 1995 and early in 2002 when it increased by 43% according to the Fed's trade-weighted measure against other major currencies. US dollar gains recorded in the current and previous bull-run still remain well below those recorded between late in 1978 and early in 1985 when it increased by around two thirds," BTMU adds.

"The yen has strengthened sharply declining by almost 10 big figures since the brief relief rally which initially followed the BoJ's negative rate announcement. The sharp pace of yen strength has fuelled speculation that Japan may intervene to dampen yen volatility. The yen is still undervalued and has plenty of scope to strengthen further. A bear trend now appears underway which could see USD/JPY falling back at least towards fair value which is closer to the 100.00-level," BTMU argues.

Near-term, BTMU is bearish on USD/JPY seeing the pair trading in 110.50-112.50 range.

For more bank trade ideas, check out eFX Plus.