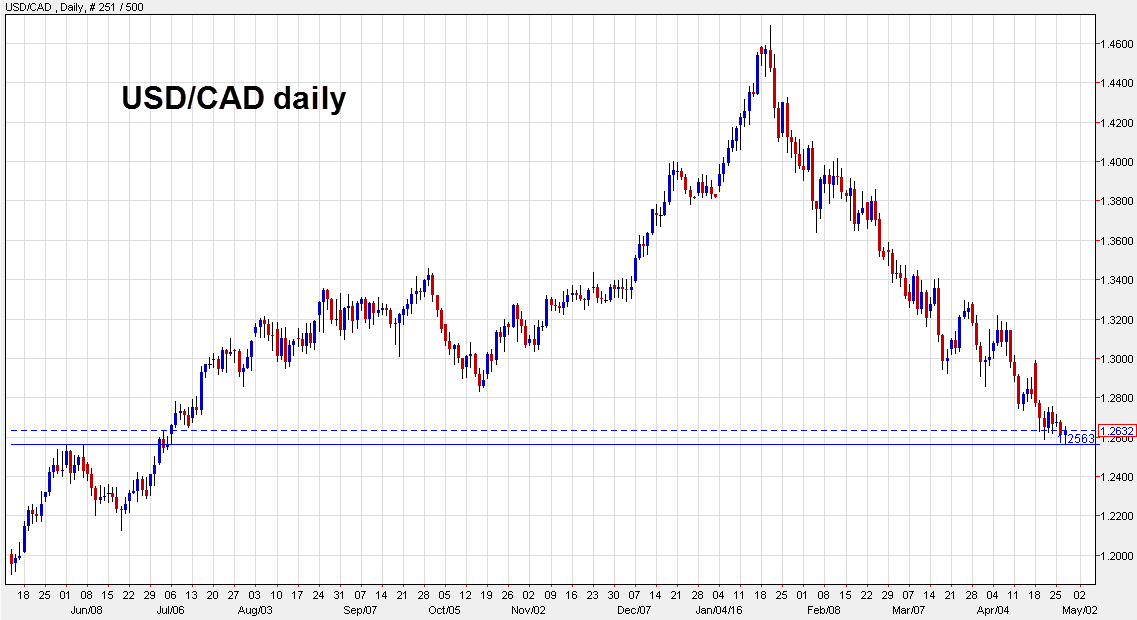

USD/CAD touched the June high

USD/CAD is down more than 2000 pips since mid-January and it touched another fresh low of 1.2572 earlier today.

The low nearly matched the June high of 1.2563. That was resistance until it broke in July and now it's modest support.

The trigger for the turnaround was the unexpected build in US oil supplies. API had hinted at a drawdown but that wasn't the case as another 2 million barrels went into US storage. As a result, USD/CAD rebounded to 1.2656. and is now consolidating 30 pips from the highs.

What's impressive is that oil has bounced back into positive territory, up 35-cents to $44.39. In the past two weeks, crude has steamrolled any negative news. One reason may be the sudden spike in Chinese commodity speculation.

The Fed announcement could be a major watershed for this pair. If the FOMC makes a hawkish shift, it would boost the US dollar and also raise questions about commodity demand.