Bank of Canada decision tomorrow at 10 AM

The USDCAD is making a break to the downside today - one day ahead of the BOC rate decision tomorrow.

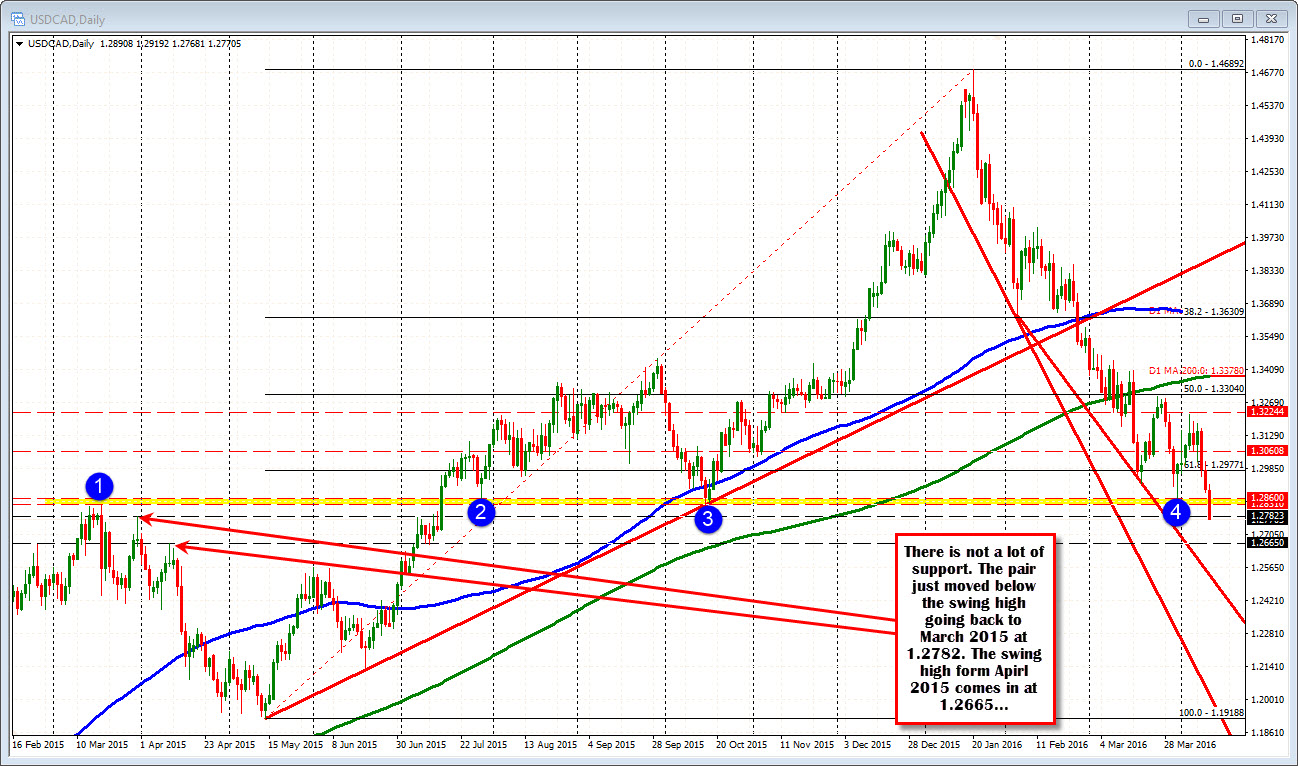

Looking at the daily chart, the pair has fallen below the low floor between the 1.2831-60 area (see chart above). That area was home to 2 swing lows and a swing high going back to March 2015. The March 2016 low stalled against the level and corrected higher (see chart above). The price momentum has increased on the break and the pair currently trades at new session lows. The pair is trading at the lowest level since July 15, 2015. There is not a whole lot of support on the daily chart until 1.2665 (see daily chart above)

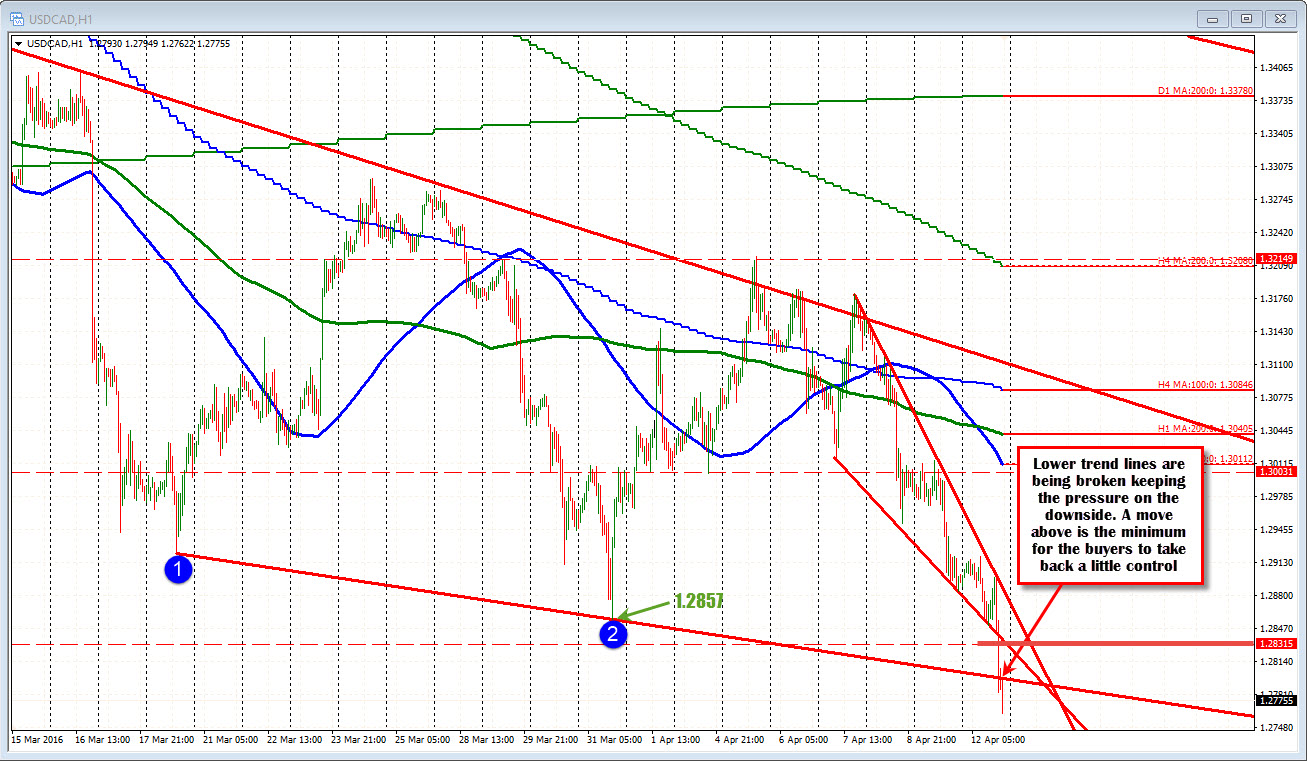

Looking at the hourly chart the price has also move below trend lined connecting the more recent March 2016 lows That line cuts across at 1.2800. This level will now be eyed as resistance for the pair on a correction.

There is really not a lot of reasons to buy the pair as it trends below technical targets and trades at new 9-month lows. Given the lack of any real strong support, it will likely be a move above a broken level (like 1.2782 or 1.2800) that may give a temporary corrective reprieve. However, that 1.2831-60 area loom not too far away and that should attract sellers IF tested on a correction before the interest rate statement.

For a preview of the BOC decision CLICK HERE