USD/CAD technical analysis

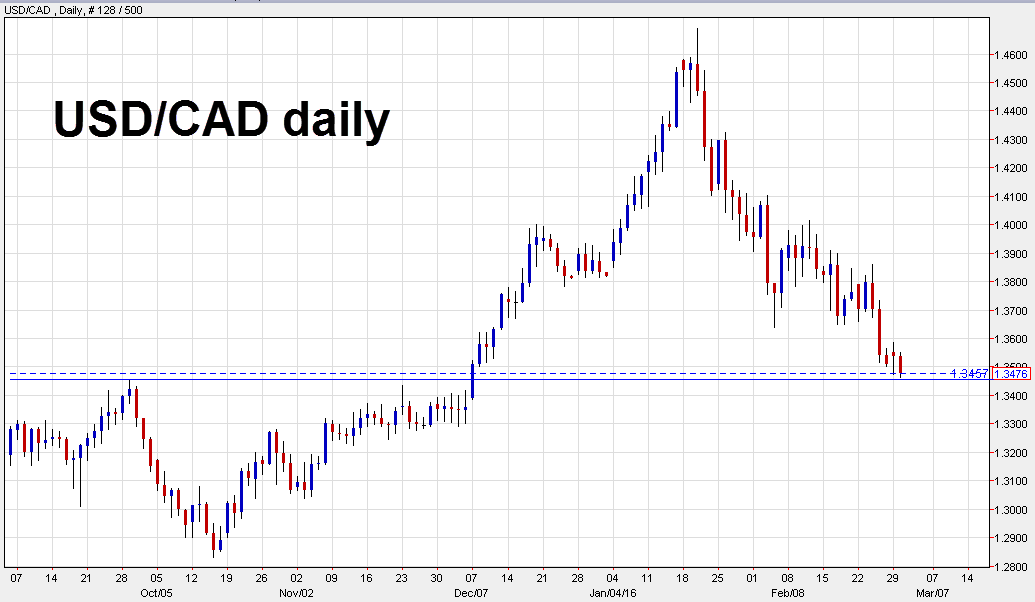

A surprisingly strong GDP report led to a quick round of selling in USD/CAD. The pair quickly fell 70 pips and touched the lowest since Dec 7 at 1.3456

USD/CAD retested the top of the old range. A series of highs there included one at 1.3457 and one at 1.3435.

The pair bounced to 1.3490 after the dip. It was given a lift by a turnaround in oil.

WTI crude prices are now flat at $33.74 after touching $34.52 in early US trading. The reversal in oil is being blamed on comments from Putin. He said he would ask Russian oil companies if they're willing to freeze 2016 output in meetings this week.

The market had though Russia had already pledged to freeze output. There's a bit of a misunderstanding here. First, this isn't the Soviet Union. Russia can ask companies to halt production but they're free to do what they want (although that's probably not a good idea). Second, the main oil executives have already said they never had plans to increase 2016 output so expect Putin to 'announce' they've agreed to the freeze later this week.

Given how the oil market reacted to these headlines, look for a positive reaction when he does.