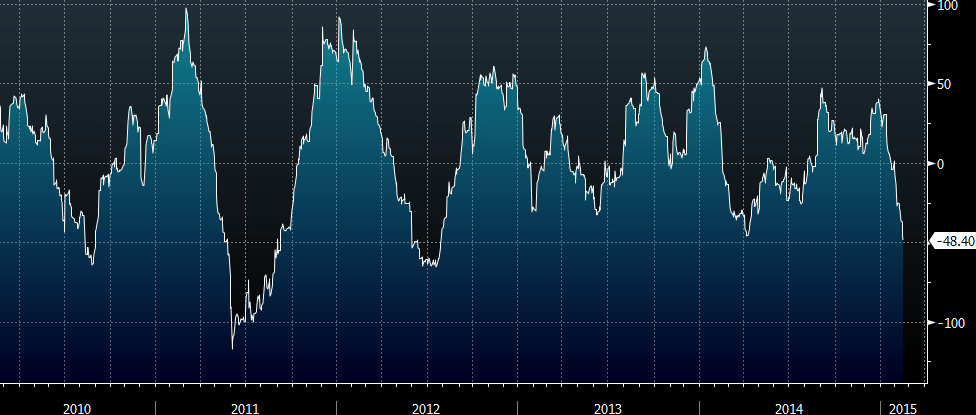

The Citi Economic Surprise Index shows U.S. economic data are failing to meet expectations by the most in more than two years

More from Bloomberg:

- The figure jibes with a Federal Reserve statement Wednesday signaling policy makers' willingness to keep interest rates low for longer, given risks to the economy ranging from a stronger dollar to wages and housing

- Many officials "indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward" keeping rates near zero "for a longer time," according to the minutes.

I had to look up 'jibes with':

"Jibe" and "jive" have been used interchangeably in the U.S. to indicate the concept "to agree or accord." While one recent dictionary accepts this usage of "jive," most sources consider it to be in error.

OK, got it!

Here it is over the past 5 years:

Here's a bit more info:

- The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news.

- They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median).

- A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus.

- The indices are calculated daily in a rolling three-month window.

- The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises.

- The indices also employ a time decay function to replicate the limited memory of markets.

-

Long story short .... US economic data is underperforming expectations, at the worst rate in >2 years